There is something happening here, what is not completely clear. With Boufalo Springfield (and then General enemyThese lines are accurately summarized for the latest encryption trend: companies building tools to develop artificial intelligence agents who use Stablecoin. It is a lot to wander around your head, but the basic idea is: in the future, we will all publish artificial intelligence agents who not only communicate, but they participate in online trade on our behalf – in building our concert tickets, for example, or imprisoning the hotel reservation.

I faced this idea for the first time last year Coinbase CEO Brian Armstrong told me that our artificial intelligence agents would carry small coding governorates – a strange but alive with me. Since then, companies have been roaming to achieve this.

The last example is Cloudflare, which runs a large part of the web traffic, and this week this week Declare “The US dollar -backed, a net in dollar, to help push the future of the financing that artificial intelligence is on the Internet.” This comes after Google Absolute New artificial intelligence payment protocol with partners such as Coinbase and AmeX includes Stablecoins support. Then there are emerging companies such as Circle and chiselWhich was founded by veterinarians, supported by PayPal paper airplane,, Which also design the procedure protocols.

As I said, there is something happening here. The case, though, is What Exactly these companies build, and who – if anyone – will end up. Yes, they are the first days and protocols must come before requests, but it will remain useful to see examples of ordinary consumers who spread these cash robots for daily activities.

The easy scenario that must be perceived is that consumers give age dealerships from Stablecoins, send them to negotiate and buy a pair of sports shoes or something like that. But will this be something that most of us need? Or is that, like a lot of encryption, just a Blockchain inauguration element on something that already works well?

To be fair, companies are already stirring some of the most exciting possibilities. This includes the idea of using artificial intelligence agents to implement precise defenses such as buying a news article behind Paywall or buying an excerpt from data from LinkedIn. Likewise, the parents between us will enjoy the idea of the agent that we can trust with personal data that can register our children and pay for sports teams and summer camps.

We discussed all this in Fortune Crypto and concluded that this fusion of stablecoins and artificial intelligence agents He is The future, but it is too early to determine the shape that the future will take. Attempting to predict in 2008 is similar to what applications will come to fill the iPhone app store, or the example of blind scientists and elephants – everything on touching the leg or trunk, but it is unable to understand how it fits everything together. It may take five years or more to know.

He talked about Stablecoins, make sure to review the latest version of Playbook Crypto Liu talks to business professor and Crypto Og Austin Campbell about where everything is going. Thanks for reading, and as always, we would like to hear your thoughts.

John John Roberts

[email protected]

Jeffjohnroperts

Decentralization news

Wen kraken ipo? Curd companies of all species are in public, including some clear d. But what about Krakin, one of the most respectable brands in the industry? A new profile reveals that the company has just raised $ 500 million on its way to subscription in 2026. (luck))

Financial lever for everyone. The encryption scene has become more expert than ever thanks to the arrival A permanent futureOr “PERPS”, on American beaches that allow anyone to make a bet of 100x. ((Wsj))

“Reflection” transactions. Circle explores a system to reverse transactions, and perhaps using Arc Blockchain. The idea of this concept, which has long been a heresy in encryption circuits, is to make the encryption experience closer to traditional banking services. ((foot))

Trading from the inside illegal. In August, luck I mentioned On suspicious share prices in companies directly before announcing Crypto Treasury Buys. SEC and Finra are achieved in the phenomenon. ((Wsj))

Everyone got Rekt This week was $ 300 billion-this is the amount of markets that were thrown amid a brutal sale of Bitcoin by about 5 % and sent ethereum to less than 4000 dollars. ((Bloomberg))

The main character of the week

The main character this week is the Chairman of the Board of Directors of Tether Giancarlo Devasini who, for all BloombergIt is about to reach a net value of 224 billion dollars thanks to an imminent deal to sell 3 % of the company for $ 15 billion to 20 billion dollars. This will be good enough to make Devasini the fifth richest person in the world, before CZ Binance, and behind some players called Musk and Zuckerberg.

Mimi, moment

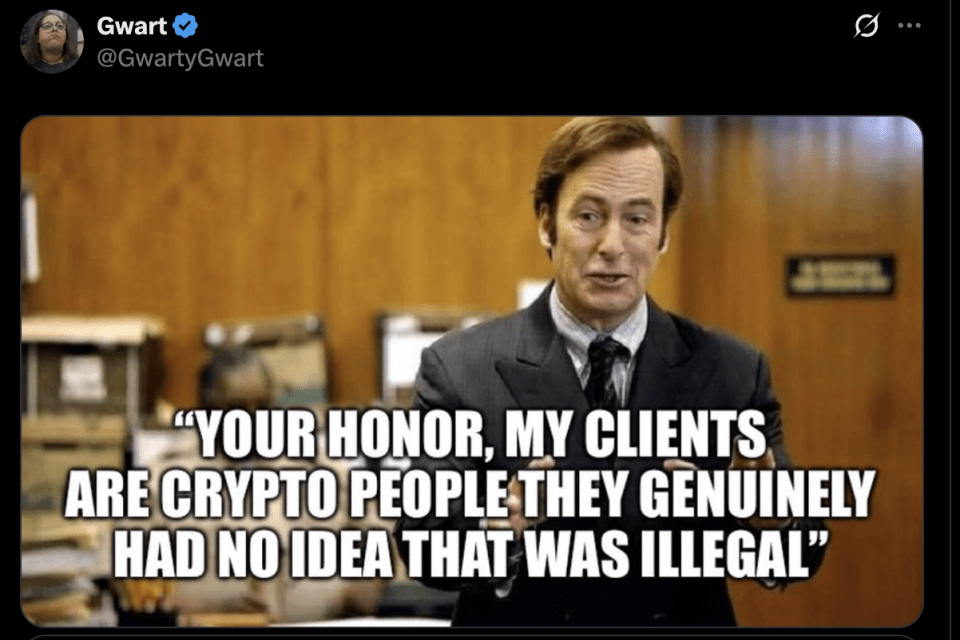

Gwartygwart

This tongue is in cheek of the cheek of people who have no idea about something illegal that comes because SEC verifies dats-reminders that, even in the Trump era of the organization, there may still be something like the crime of white collars.

https://fortune.com/img-assets/wp-content/uploads/2025/09/GettyImages-2194278597-e1759069992798.jpg?resize=1200,600

Source link