On Saturday, the White House issued a study estimated that 8.2 to 9.2 million Americans could be without health insurance as a result of the next stagnation if President Donald Trump is “Big and beautiful invoice” On the budget does not pass.

The result comes from the White House Economic Advisors Council A note entitled, “The cost of an alternative opportunity for health insurance if 2025 proposal to the budget settlement project does not pass.”

Research is assumed that the United States has approximately 27 million non -believers in 2025. If the budget bill does not pass, this may increase to about 36 million non -insured people, much closer to about 50 million people who were not secured before the implementation of a reasonable price law (ACA), also known as obamacare, in 2010, according to the standards.

“Failure is not an option,” says tax author of the House of Representatives.

President Donald Trump during a ceremony was sworn by Steve Wittak’s special envoy at the White House in Washington, DC, May 6, 2025. (Reuters/Kent Nishimura/File Photo)

The memorandum says that the estimate “depends on the assumption that the countries that have expanded Medicaid with relatively generous eligibility will decline to meet the balanced budget requirements and try to provide more unemployment support during the severe recession.” It is also qualified for its conclusions by saying that the analysis assumes “any anti -policy measures”, which is what White House The scenario describes “it is very unlikely but worse.”

The White House begins that the expiration of Trump’s tax discounts in 2017 in 2026 and other shocks that would lead to “moderate to severe stagnation.” Economic consultants state that the “main recession” will lead to a decrease in spending on consumers as a result of increasing individual taxes, reducing investment in small businesses and employing it as a result, as a result of individual taxes, the shock of global confidence, including concerns related to American competitiveness, tightening contraction in dollars in the dollar and paying real interest rates to the top.

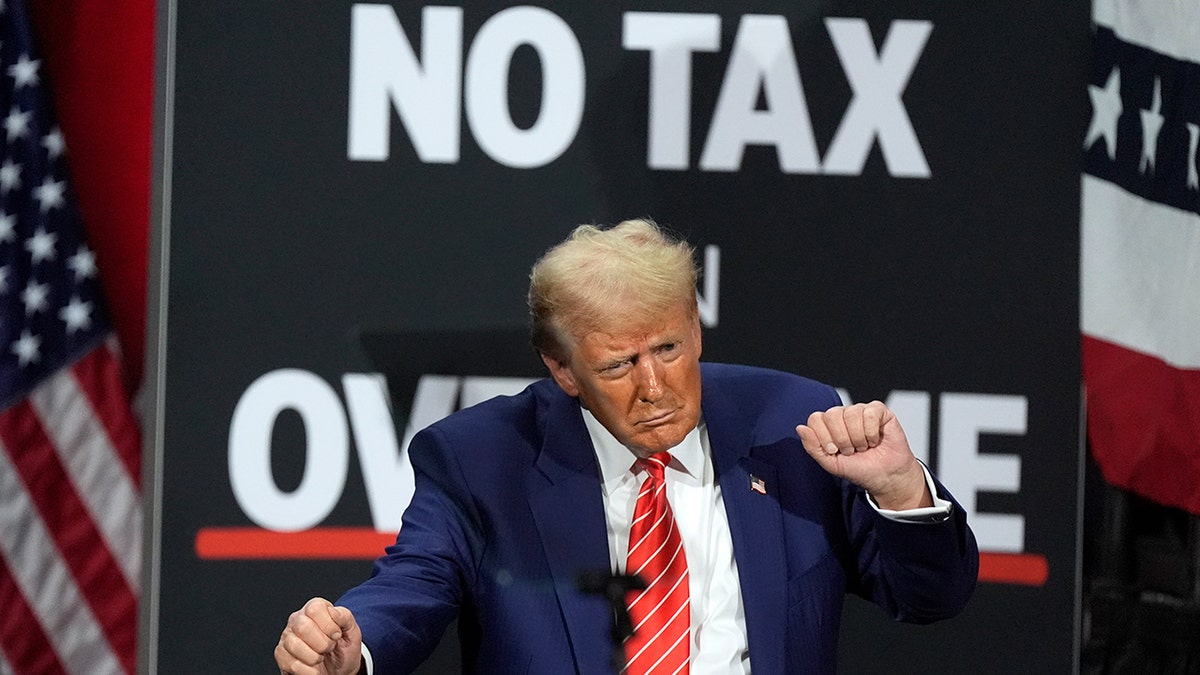

Republican presidential candidate Donald Trump fell at a campaign event at the Cope Energy Center for Dramatic Arts, October 15, 2024, in Atlanta. (AP Photo/John Bazemore, File)

According to the “higher” estimates of the advisers of the effect of the non -extension of tax cuts in Trump, the US GDP can contract approximately 4 % over two years – similar to the 2008 stagnation. Unemployment can rise by four points, leading to about 6.5 million business losses. Among those 6.5 million job losses, 60 % had insurance under the auspices of the employer, and therefore the White House projects have lost about 3.9 million people to cover and become unbelievable as a result.

The memo also expects to lose individual coverage and the market, because those that are not already able to insure the employer are to buy insurance themselves. The White House expects a 15 % decrease from about 22 million registered in 2026 to about 3.3 million losing coverage.

Parliament Speaker Mike Johnson, R, speaks. , During a press conference in Capitol, May 6, 2025, in Washington. (AP Photo/Rod Lamkey, JR., File)

Without passing “Big bill, beautiful,” Medicaid and ACA may suffer from joining the subsidized plan by 10 % of enrollment frictions, which leads to approximately 500,000 to a million people losing or failing to obtain coverage, the memo mentioned. The end of the tax cuts in Trump for the year 2017 would affect non -proportionally non -citizens, party workers and first retirees, according to the White House. Advisors evaluate that individuals in those classes operating without insurance under the auspices of the employer will not be able to bear the costs of coverage as a result of stagnation, which leads to 500,000 to a million insurance losses between “weak sectors”.

Parliament Speaker Mike Johnson works, R. La.

The bill, which amounts to 1,116 pages, includes more than $ 5 trillion of tax cuts, and the costs that are partially compensated by discounts in spending in other places and other changes in the tax law, and will make permanent tax cuts from Trump’s first period.

Click here to get the Fox News app

He also realizes many Trump’s promises in campaigns, including temporarily terminating taxes on additional work and advice for many workers, which creates a $ 10,000 tax break on the interest of car loan for US -made cars, and even creating a new tax “Maga account” that will contribute to $ 1,000 for children born in his second term.

The Associated Press contributed to this report.

https://static.foxnews.com/foxnews.com/content/uploads/2025/05/trump-serious.jpg

Source link