A source of revenue for the federal government can be reduced significantly if the Supreme Court adhere to that it is a decision that President Donald Trump’s mutual tariff is illegal.

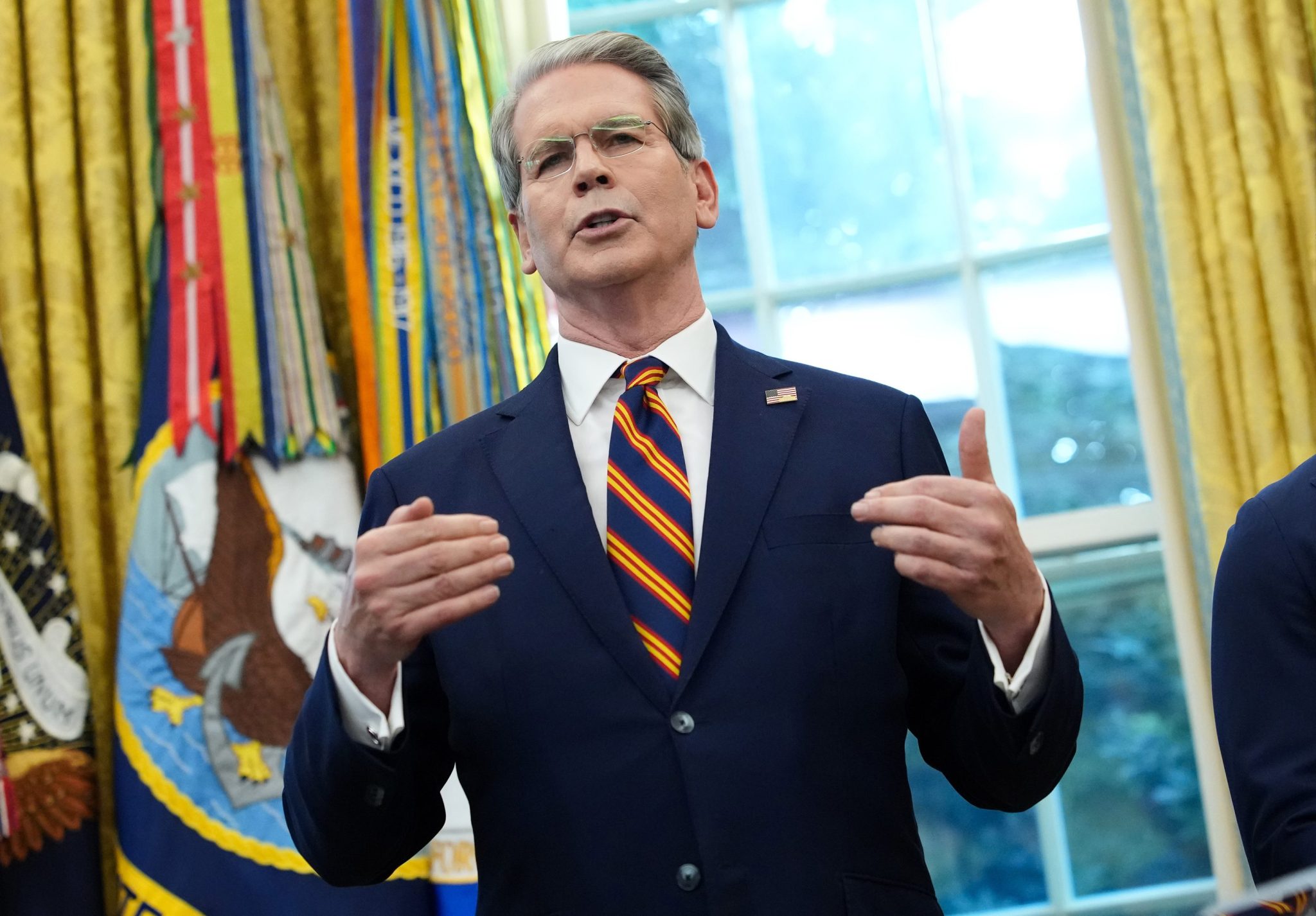

on NBC Meet the press with Christine Wilker On Sunday, Treasury Secretary Scott Bessin expressed their confidence that the judges will stand with the Trump administration, adding that there are “many other ways that we can take” even if they did not.

But he acknowledged that if the Supreme Court opposes the administration, the United States will have to recover about half of the definitions, which will be terrible for the treasury.

Late last month, a Federal Appeal Court A previous ruling issued by the International Commerce Court, which found the legal basis for customs duties under the IEEPA (IEPA) law was not valid. Resolution 7-4 until October 14 will not take place to give the administration time to appeal to the Supreme Court. This does not affect the sectoral tariffs, such as those in cars, aluminum and steel, which were imposed under a separate legal basis.

To date this orthodontic year, the United States raised $ 158 billion of customs tariff revenues, According to the White House. This includes the IEPA tariff that is challenged in court and those that are not.

Trump’s total tariff system has emerged as a decisive source of revenue, especially after legislators reduced taxes, and it was expected to generate $ 300 billion-400 billion dollars per year.

In fact, the surprise is so important that the S& P Global was martyred when Re -confirm American credit classification and expectations. In addition, the Congress Budget Office estimated that the definitions would work The trillion dollars fly from the federal budget deficit.

Although all the revenues of the customs tariffs of the federal government are not at risk, the loss of a large part of the huge will continue to create corruption in the deficit and bond market.

Thomas Ryan, an economist in North America at Capital Economics, said in a memorandum on Tuesday that the loss of IEPA tariff will reduce the actual tariff rate to about 8 % of 17 %. As a result, the federal budget deficit will increase approximately 7 % of GDP, up from about 6 %.

“This alone raises more concerns about financial expectations, and bond returns are likely to pay higher,” he added.

In a more clear scenario, as the Supreme Court takes another six months or so to the ruling and contradicts the customs tariffs, the deficit will approach 8 % of GDP.

But the end of the IEPA tariff will provide an elevator for the economy, assuming that Trump is not replaced by more duties. If this is the case, the fiscal policy will create a net impact that stimulates about 200 billion dollars instead of being more neutral, as estimated. The risk of inflation will also be further reduced.

At the same time, and The latest job report He emphasized that the labor market was sharply weakened during the spring and summer seasons and that the sectors most affected by the definitions have witnessed the largest losses.

But in reality, Ryan said it is possible that the administration will expand the customs tariff that was called under a separate legal basis to compensate for the incoming revenues of the lost IEPA, “maintaining an effective rate of at least 10 % and reducing the size of any incentive.”

https://fortune.com/img-assets/wp-content/uploads/2025/09/GettyImages-2233913598-e1757259641659.jpg?resize=1200,600

Source link