- Wall Street expects the Federal Reserve will reduce prices by 0.25 % next weekAlthough some of them speculate Jerome Powell, they can make a 0.5 % “jumbo” step, given how twice the labor market data is recently. Global Markets and US S & P 500 have risen to the cheapest money expectations, but there are still two other rounds of inflation data before calling the Federal Reserve.

S& P 500 futures increased by 0.25 % this morning as investors, after they were digested as bleak data from the labor market in the United States last week, feeling a 0.25 % reduction in interest rates from the Federal Reserve.

The consensus is that the Federal Reserve will only provide 0.25 %. But a minority of speculators – less than 10 % only – in the CME Fends Funds Victrods market believes that 0.5 % may happen.

“The broader market psychology in the market has turned,” George Vice “said in a note this morning.

Pantheon expects the total economy three discounts of 0.25 % this year; Widbush Seth Basham expects two.

With the expectations of a new round of the cheapest money coming down in the tube, the global markets were all this morning.

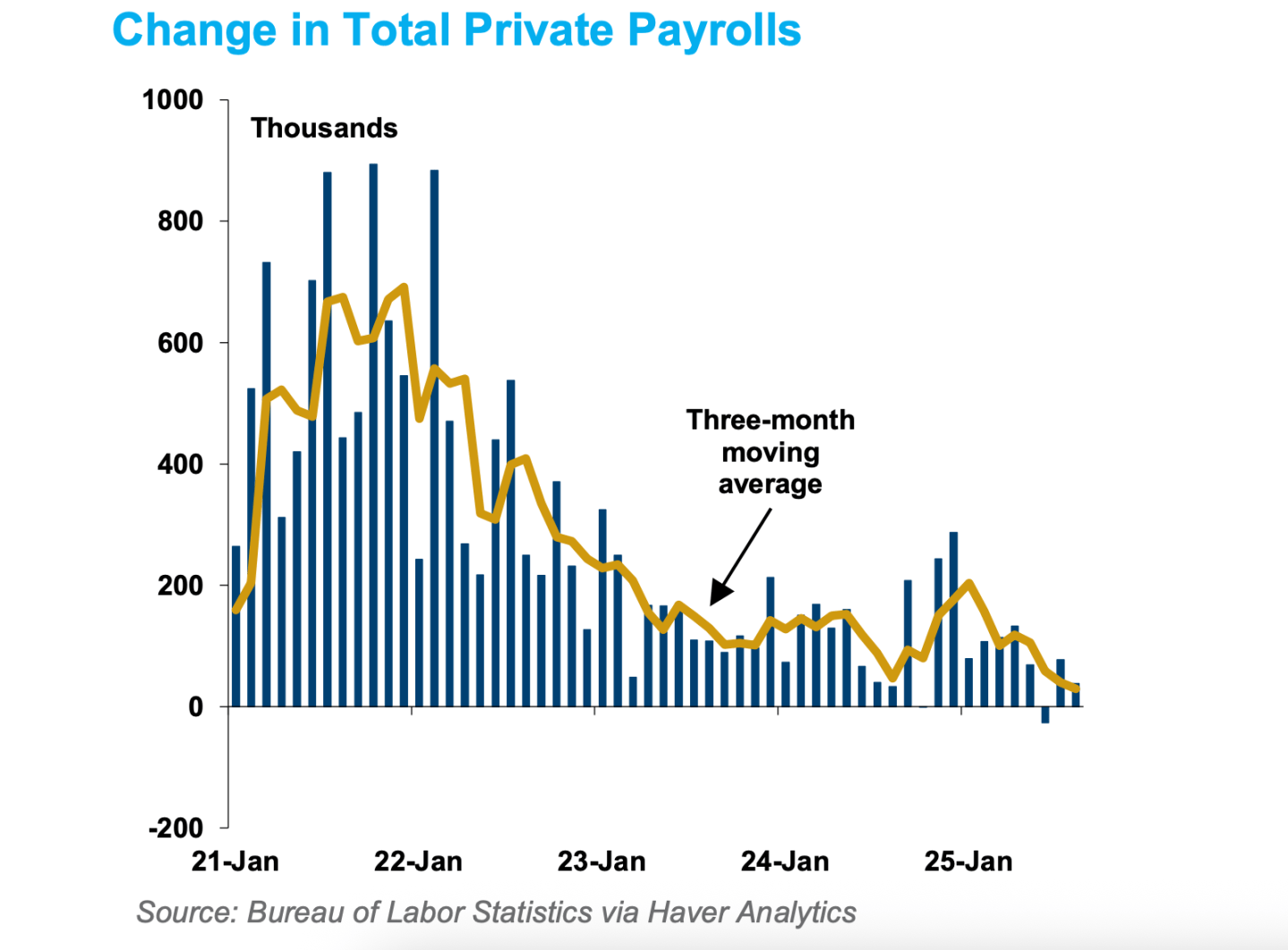

The reason is that investors are sure that the discounts are coming is that under the number of weak addresses of the non -agricultural salary report – 22,000 new jobs – weaker data from the private sector. Job growth Be negative In the sectors most exposed to President Trump’s commercial definitions, according to the Apollo management. The revised job number was negative.

In the private sector, the average job growth was only 29,000 per month in June to August, according to a memorandum issued by Daiwa Capital Markets, average average of 100,000 per month in the first quarter – before the definitions closed:

Lawrence Wester and Brendan Stewart from Dawa refers to another dark index: the publication of salary statements in the private sector-which acquires 258 private sectoral industries-that more companies cut jobs from employing new workers. The scale fell to 48 in August – anything less than 50 indicates negative employment.

The Federal Reserve will be under pressure to support the full recruitment aspect of its double mandate. There is a fly in Powell. We will get new numbers for the producers’ price index and consumer price index this week, and the expectation is that it will show the continued inflation in the rise. The other half of the Federal Reserve Bank is Flght – which is why some economists still say that the 25 % reduction is not guaranteed as stock markets assume.

“Although the Fed Bank is now on the media, and PPI on Wednesday, especially the consumer price index on Thursday, the prices will be before that,” Jim Reed team in German bank Tell customers this morning. “So a quarter of a full point is priced, but without much pricing through a 50 -bit step per second. Our economists think you need to see very weak inflation this week to get it.”

Here is a snapshot of markets worldwide this morning:

- S & P 500 futures contracts 0.25 % rose this morning. The index closed 0.32 % in the last trading session.

- Stoxx Europe 600 0.34 % rose in early trading.

- FTSE 100 in the United Kingdom It increased by 0.17 % in early trading.

- Japan Nikki 225 It was 1.45 %.

- China CSI 300 It was 0.16 %.

- South Korea Cuban It was 0.45 %.

- Elegant India 50 It increased by 0.13 % before the end of the session.

- Bitcoin She refused to 111.6 thousand dollars.

https://fortune.com/img-assets/wp-content/uploads/2025/09/GettyImages-2230622673_12c015.jpg?resize=1200,600

Source link