When it comes to Japan, it seems that President Donald Trump’s plan to use definitions as a way to enhance local production is working so far.

Marcel Thillant, head of the Asia Pacific Region at Capital Economics, said in a memorandum on Thursday, quoting recent data from the bank of Japan, that the volume of exporting Japan to the United States has decreased to the weakest level since 2021 while its total exports remain higher than the average of 2024.

“What has become increasingly clear is that companies respond to US tariffs by intensifying production in US subsidiaries,” he said.

In the second quarter, the foreign subsidiaries of Japanese manufacturers in North America booked the growth of sales, which were 6 degrees Celsius faster than the total exports in Japan to the region.

In July, production in the American Toyota factories increased by 28.5 % from last year, but production in its factories in Japan decreased by 5.5 %.

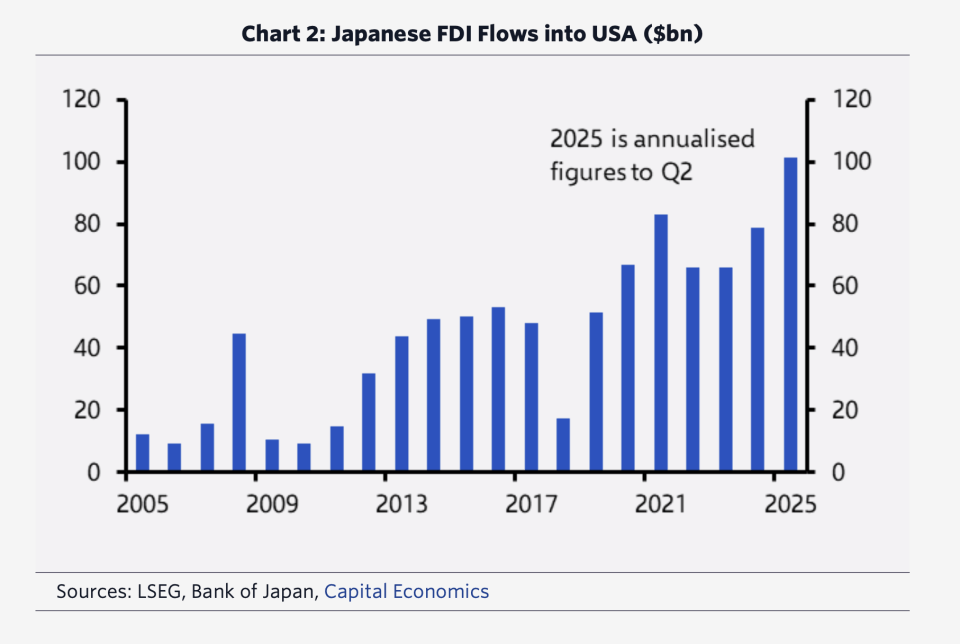

Along with this transformation in production is the flow of capital. Thieliant estimated that foreign direct investment in Japan in the United States is going quickly in obtaining a record level this year, while the total foreign direct investment will not change much. As a result, the United States may get 47 % of the total foreign direct investment in Japan this year, which represents the highest level ever.

He added that all this investment is not only because of the Trump trade deal. Instead, the main engine is the strong American economy as it surpasses Europe, which was previously a larger destination in foreign direct investment in Japan. In fact, investigative studies of 2024 showed nearly half of Japanese manufacturers with external subsidiaries to expand US production.

“The decline, the fatching exports are a opposite wind of economic activity in Japan,” said Thillant. “But as long as companies are able to continue serving American customers through US subsidiaries, the influence of companies’ profits, investment and wage growth must be minimal. ”

Investment from Japan can see a greater increase in the coming years. In July, the United States reached a commercial deal that reduced the rate of tariffs on Japan to 15 % of 25 % of Trump. On the other hand, Japan agreed to For $ 550 billion In the major American industries, through a “Japanese Investment/USA” investment vehicle, it will be published “towards President Trump.”

It includes energy production and production infrastructure, semi -conductors, critical minerals, pharmaceutical preparations, and shipbuilding, according to Fact leaf from the White House at that time.

Wall Street expressed serious doubts that $ 550 billion will actually be achieved. Analysts at Piper Sandler said in July. Trump’s tariff is illegal– And face The continuing court challenge– Noting that the Japanese investment pledge comes with a few concrete details.

They wrote: “Our commercial partners and major multinationals know that Trump’s tariff is on a fragile legal basis.” “Therefore, we find it difficult to believe that many of them will make huge investments in the United States, so they will not have done otherwise in response to the definitions that may not last.”

Meanwhile, on the other side of the commercial deal, the revival of American manufacturing will require more The workforce has a shortage.

The country is short 600,000 factory workers and 500,000 construction workers at the present time, and it will need LinkedIn post In June.

On Monday, he said that the United States had ignored the work necessary to build databases and manufacturing facilities.

“I think the intention exists, but there is nothing to cancel the ambition,” Ferley He said Intuition. “How can we restore the beach of all these things if we do not have people to work there?”

https://fortune.com/img-assets/wp-content/uploads/2025/09/GettyImages-1173365368-e1759161676607.jpg?resize=1200,600

Source link