DUB Stephen Wang CEO of President Donald Trump’s leading movement to settle the stadium to the work of Americans through his new executive order at “Varney & Co.”

president Donald TrumpThe executive thing that directs financial organizers can include alternative investments in retirement plans such as 401 (K) funds can change investment portfolios in Americans.

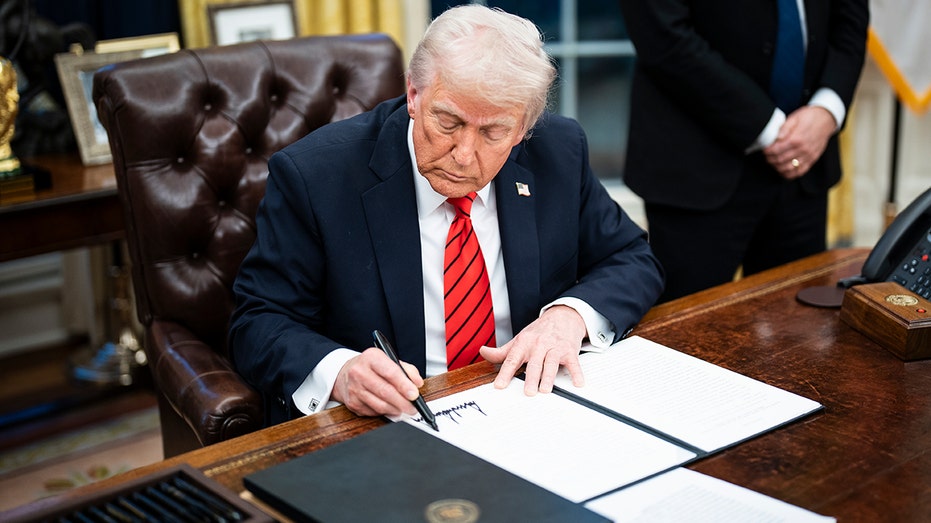

Trump signed the Executive Order on Thursday, and the White House presented a fact card that the Ministry of Labor directed to reconsider its guidance regarding Alternative assets in 401 (K) And the specified retirement plans. In addition, the agency will work with the Ministry of Treasury, the Securities and Stock Exchange Committee to determine whether organizational changes are needed to implement the purpose of the matter.

It defines “alternative assets” as it applies to private market investments; Direct or indirect real estate interests and infrastructure projects; The digital assets held in the investment vehicles managed actively; And longevity risk sharing gatherings. Federal organizers will have to go through the process of setting rules, which means that new investment options may not be available until 2026.

The expansion of the types of assets that can be considered in 401 (K) and similar retirement plans provide new investment opportunities for those who provide retirement – although new asset categories can suffer from more fluctuations than other investment categories, and thus should be dealt with caution with consideration of investors in the best way to diversify their portfolios.

Trump signs of requesting 401 (K) on private markets: What does that mean for your retirement

President Donald Trump has signed retirement plans to open an executive order for new investment categories. (Jabin Botsford / The Washington Post via Getty Images / Getty Images)

“The private investments in 401 (K) plans have the ability to improve the results of the participants by providing access to individuals to the same scope of investments as professional institutional investors, who seek to provide long -term returns and additional diversification,” said ARAI Jacobs, Global Investment Head of AON.

“The implementation of these solutions requires a deliberate and strong analysis of the main factors such as the skill of the manager, fees, liquidity and evaluation.”

“Attention between the Plan’s sponsors in Private investment “The options that include private credit, private shares, infrastructure and real estate in growth,” said Jacobs, adding that the industry has made great progress in developing these solutions “to meet the needs of specific contribution plans.

How should you deal with 401 (K) or the Irish Republican Army while the market fluctuating?

Digital assets such as Bitcoin will be in investment vehicles managed by activity available under President Donald Trump. (Istock)

“The company, including private markets, in a professional pension products, such as the target history funds, allows wise exposure to alternatives – may enhance revenues and diversification – without asking individual investors to manage complications or liquidity restrictions themselves.”

He said that the company’s research indicates that the allocation of private shares by 10 % to the target date fund would be improved useful to the cuiber in the fund, which enhances the accumulation of wealth when retiring with a greater annual flow to increase Retirement.

“The private market investments are not suitable for every investor because of its lack of blood and its complexity, but the professional orientation customization can help ensure the suitability and support of the stronger long -term results for the participants in the plan,” he said.

The executive request will expand the types of assets available to investors in 401 K (K) accounts and other selected retirement accounts. (Istock / Istock)

Leanna Haakons told the financial suspension and head of Black Hawk Financial, Fox Business “Change” in a position every day Retirement On the same stadium as institutional investors, they give access to strategies and asset categories that were intended for pension funds, standing, and very high network governor. “

“Allowing the inclusion of alternative investments such as real estate, private shares, investment capital, and digital assets creates great diversification opportunities and the possibility of obtaining long -term returns higher.”

“However, investors must also face liquidity restrictions, high management fees, the need for financial education and due care; this makes this a strong opportunity that requires accurate and informed participation.”

Get Fox Business on the Go by clicking here

Haakons added that the actual availability of new alternative investment options in plans is unlikely to be widely available until next year due to the organizational processes and directives that must be developed, while investment companies must ensure that their products are compatible before they are offered to the pension plan.

https://a57.foxnews.com/static.foxbusiness.com/foxbusiness.com/content/uploads/2025/08/0/0/donald-trump-signing-executive-order-tariffs-01.jpg?ve=1&tl=1

Source link