On the aftermath of Nafidia $ 100 billion investment In Openai, two Wall Street’s research indicates that the current mutation in artificial intelligence may be not sustainable.

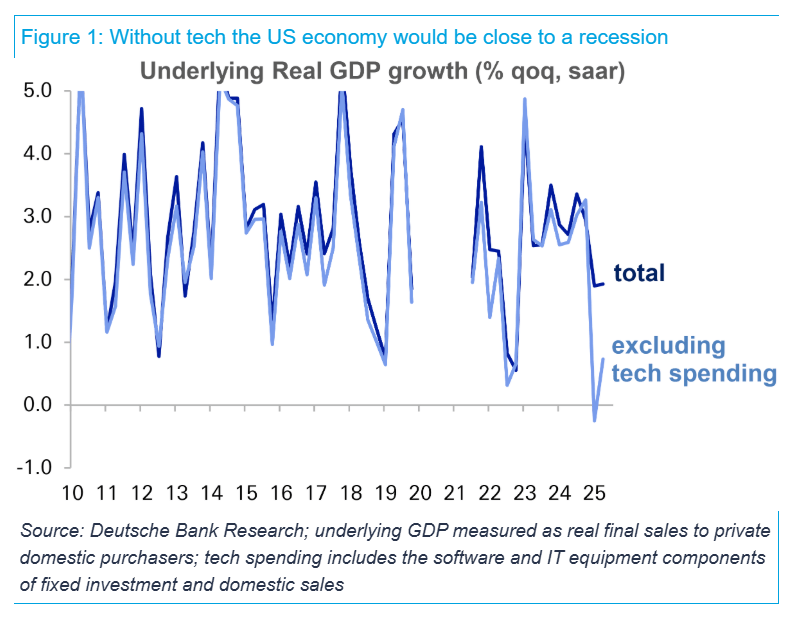

“AI machines – in the literal sense – appear to save the American economy at the present time,” George Saravilus of Deutsche Bank told customers in a research note. “In the absence of technology -related spending, the United States will be close to recession or this year.”

Separately, says the annual global technology report for Bain & Co. Artificial intelligence will not be able to achieve sufficient revenues to maintain the strength of the computing you need to build. “The annual revenue of trillion dollars is what is required to finance the computing power necessary to meet the expected demand of artificial intelligence by 2030. However, even with AI’s savings, the world is still less than $ 800 billion to keep pace with the demand,” The report says.

The stock market was highly driven this year by wonderful technology shares 7, based on its spending on artificial intelligence and revenues it generates from capital spending from AI from other companies.

However, there is no consensus on the Wall Street on this. Goldman Sachs took a more upward view this morning. “We expect the productivity gains from artificial intelligence (AI) will greatly enhance about 0.4 % over the next few years and 1 % comedy with long -term high adoption. Once it is widely adopted, AI may allow artificial intelligence to ABECIS. luck.

Estimates differ about how much artificial intelligence spends in databases and the huge energy infrastructure they need. Goldman Sachs estimated AI Capex $ 368 billion until August this year. Saravilus of Deutsche said: Whatever the number, it is so huge that it enhances the gross domestic product.

“It may not be that it may not be to write that NVIDIA – the main supplier of capital commodities for the investment cycle of artificial intelligence – currently holds the weight of American economic growth. The bad news is that in order for the technical cycle to continue to contribute to the growth of GDP, the investment in the capital must remain equivalent. This is very unlikely.”

He also pointed out that “growth does not come from artificial intelligence itself, but rather from building factories to generating the ability of artificial intelligence.”

Jim Reed of Deutsche Bank said in a separate note published this morning this morning, that artificial intelligence spends the stock market as well, and Jim Reed from Deutsche Bank argued in a separate note published this morning. His team said: “The S& P 500 has now increased +13.81 % so far this year, while the distributed equal version rises only +7.65 %. Or in other words, it was 7 wonderful to lead the gains.”

Torsten Släk from Apollo Management Consistently: “Reviewing the upscale consensus until 2026 of the S&P 500 profits since the liberation day comes fully than the wonderful 7, see the graph below. The expectations for the rest of the economy are more down: The profit expectations for the S&P 493 have remained repression and not move higher.”

“There is a great degree of focus in the S&P 500 index, and investors are highly exposed to the artificial intelligence agency.”

Below is a snapshot of markets before the opening bell in New York this morning:

- S & P 500 futures contracts It was flat this morning. The index closed 0.44 % at its last session, reaching the highest new level ever at 6,693.75.

- Stoxx Europe 600 The increase of 0.48 % was in early trading.

- FTSE 100 in the United Kingdom An increase of 0.35 % in early trading.

- Japan Nikki 225 It was 0.99 %.

- China CSI 300 It was flat.

- South Korea Cuban It was 0.51 %.

- Elegant India 50 It was flat before the end of the session.

- Bitcoin It rose to 113.1 thousand dollars.

https://fortune.com/img-assets/wp-content/uploads/2025/09/GettyImages-2207909209.jpg?resize=1200,600

Source link