SEC Paul Atkins President “Al -Sabah with Maria” tells that President Donald Trump’s pushing to end the quarterly profit reports is a “timely invitation” as the organizers weigh a long -term growth on Wall Street “the short term.”

Securities and Stock Exchange Committee (Second) Paul Atkins said on Tuesday that the Trump administration plan to open retirement accounts 401 (K) for the private market investments will give ordinary Americans safely to the opportunities currently restricted.

Atkins said that the Supreme Education Council will work with the Ministry of Labor to expand access to investments in private funds for ordinary investors who will not currently pay the regulatory borders that will provide them with access.

On Tuesday, Atkins said on Fox Business.Morning with Maria“

“Frankly, it is not justified to be a public company, or it has become so, and I want to make public subscriptions great again,” said Atkins. “Thirty years ago or so, when I was a young lawyer who started in New York, companies like Apple and Microsoft – they had to announce capital to build their companies and new products.”

Trump signs of requesting 401 (K) on private markets: What does that mean for your retirement

SEC Paul Atkins Chairman said the organizational handrails will help ordinary investors to invest safely in private funds. (Stephanie Reynolds / Bloomberg via Getti Emose / Tire)

Atkins said: “Today is (the opposite).

“Then, the weapon of corporate governance is, so these issues have really reduced the attractiveness of being a public company,” he said. “We aim to improve this again.”

Currently, investments in private companies are limited to people who are satisfied The “accredited investor” threshold. Al -Qaeda aims to protect non -advanced investors from the financial risks associated with investments in private companies, which can be non -liquid and are not subject to the requirements of public financial reports.

Trump SEC President SEC asserts the choice of Paul Atkins

SEC and the Ministry of Labor work on regulations to allow private market funds in 401 plans (K). (Reuters / Jonathan Ernst / Reuters)

Al -Qaeda states that qualified accredited investors must have a net value of more than one million dollars except for their basic stay, or their income more than $ 200,000 individually (or $ 300,000 as a couple) every two years of the past two years, with reasonable expectation this year.

It also includes professional criteria for meeting the base, including Investment professionals Through Series 7, Series 65 or Series 82 License or CEOs of the company who sell security or family agents to family offices and knowledgeable employees on a special fund they want to invest in.

Atkins explained that the private market investments can help investors diversify their portfolios as public markets have become more concentrated, indicating the rise of the so -called “Seven Great” stocks Which has paid a lot of market gains in recent years.

The Minister of Labor reveals an unprecedented plan to reduce 63 “old and exhausted” rules

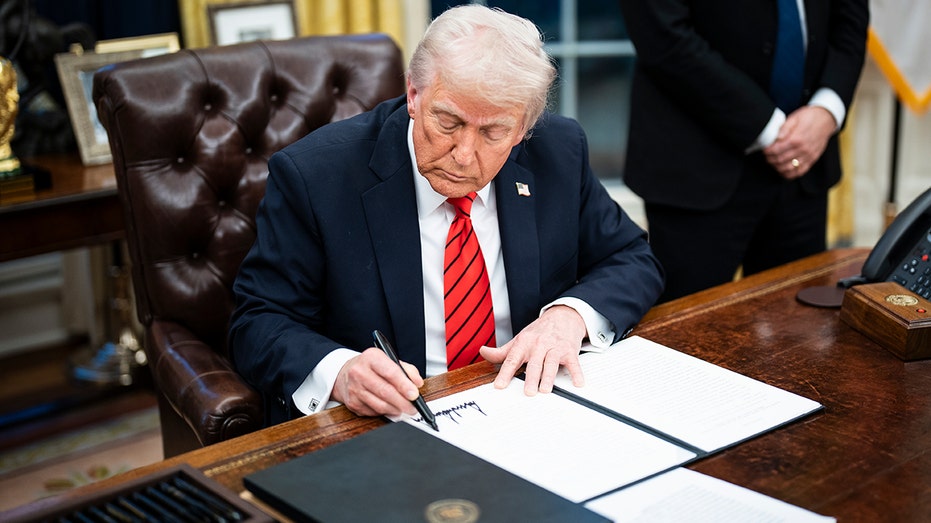

President Donald Trump has signed an executive order this summer that allows special funds in 401 plans (K). (Jabin Botsford / The Washington Post via Getty Images / Getty Images)

“We have only half the number of public companies as we had 30 years ago, and if you look at the S&P 500, it is somewhat heavy in relation to the” wonderful seven “.” What is the industry in which they are? It is basically technology, and we saw what happened in the past when the market is concentrated. “

The SEC president indicated that the work still has to be done Organizational handrails To open private market investments for retailers before they are available as options in their retirement plans or other investment accounts.

“The keyword here is diversification, and therefore we have to put handrails for retailers to expose these types of investments because they can be ungrateful, the assessments can be suspended,” said Atkins. “There is a full set of things – where the retail investor in the company’s capital is suitable for, then finally what is the liquidity of the investment.”

Get Fox Business on the Go by clicking here

“We have to put the handrails around them, and get” the most preferred nation’s position “for these types of investments. It is clear that their advisers will get a credit duty and this type of things. So we will put protection to ensure that we are keen on bad results to the extent that we can.”

https://a57.foxnews.com/static.foxbusiness.com/foxbusiness.com/content/uploads/2025/09/0/0/sec-chairman-paul-atkins-01.jpg?ve=1&tl=1

Source link