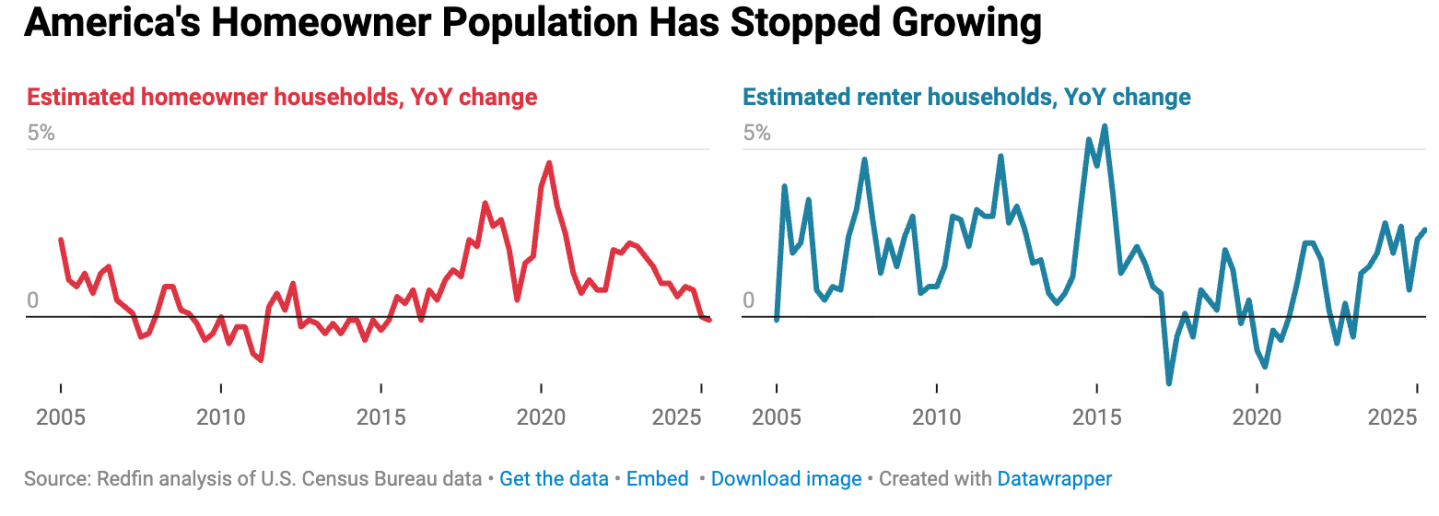

For the first time since 2016, America’s ownership rate has led to negative lands, indicating an accurate but deep shift in housing dynamics in the country, Redvin reports In its new analysis of the American Statistical Office data. In the second quarter of 2025, the number of household owner’s families in the United States decreased slightly, by 0.1 % on an annual basis to 86.2 million, while rented families increased by 2.6 % to 46.4 million – one of the largest increases in modern memory. The unavoidable result of the long flat line appears in the housing market Mortgage rates are more than weak Between January 2021 and October 2023.

Redfin puts the matter frankly: American residents at home have stopped growing. Chen ChaoThe head of Economy Research in RedFin attributes this to “high prices for home, high real estate mortgage rates and economic uncertainty (which) has made it increasingly difficult to own a house.” Zhao also indicated in secular transformations in the economy that may play a role. “People also marry and start families later, which means that they are buying homes later – another factor that may be in play.”

At first glance, a 0.1 % decrease may seem small, but it represents a fixed climb and suggests deeper challenges in roaming the market. The average price of house sale increased by 1.4 % year on a year in July to 443,867 dollars, the highest number in July. Meanwhile, mortgage rates now reach 6.56 %, that is, more than the weakening of the signing registered during the epidemic – the time when homes seemed accessible to many. RDFIN notes that this cost millions of Americans the chances of building the main wealth, as choosing to continue to rent instead of buying a house means that they are abandoning home stocks.

Ritholtz wealth management coo nick maggilli I spoke to luck In early August on his new book, “Gossip“But also what he calls”Broken housing marketHis research shows that America had not had a lot of tenants before, and while he did not reveal his personal income, he said he was one of the successful Americans who decide that rental is the right approach.and “Because it is not logical to buy, especially when the prices are, prices, everything.” The current situation of the housing market “does not add” to its status.

The tenants rise with the frequency of buyers

While Flatline homeowners, the rented population is rising. An increase of 2.6 % in rented families totaling 46.4 million – one of the largest jumps seen in years. Redfin certainly declares that these transformations are simple but noticeable in a largely broader image, as the average ownership of the houses remained relatively fixed, and 65 % in the second quarter, a decrease from 65.6 % in the previous year, while the rental rate was 35 %, slightly increasing from 34.4 % in the previous year.

The RDFIN report also highlights sharp geographical discrepancy. In many major urban areas, ownership of homes is behind the national average. Los Angeles publishes only 46.4 % home ownership rate, as tenants include more than half of the market (53.6 %), and New York City is similar, by 49.4 % and 50.6 %, respectively. San Diego, Las Vegas, San Francisco and San Jose have a few 50 % royal royal rates, but they are dominated by tenants, and revealed how the issues of the ability to afford costs in urban centers tend to balance away from ownership.

On the contrary, some areas of the trend. North Port, Florida, includes the highest rate of home ownership between the large metro of 79.5 % (the tenant 20.5 %), while Patton Roj, Los Angeles, Charleston, SC, the best 75 % of the ownership of the home. Like a lot of sun belt, these areas continue to attract buyers, and are often drawn with low prices and strong housing supply.

Although mortgage rates have begun to decrease in recent weeks, they give up slightly from the peak of more than 7 % earlier this year, the ability to withstand costs is still a major concern. Combining high prices with high rates and economic uncertainty to maintain many ambitious homeowners, while those looking for homes are inconsistent with intense competition and narrow width.

It is part of a wider economic image as President Donald Trump has been trying to restructure the American economy with great definitions on many trade partners for a long time, which leads to uncertainty in business and increasingly frozen job market, especially since the legitimacy of definitions is heading to the Supreme Court. Customs duties are also looking to push sticky inflation, as Trump presses the Federal Reserve Chairman Jerome Powell to reduce prices, in a large part of it to move the housing market again. All the time, a lot of growth in the stock market is driven by technology technology and artificial intelligence stocks, especially the huge investment at the country level in data centers, as many investors have begun to see a bubble signs that may end before any other shoes decrease.

For this story, luck The artificial intelligence is used to help with a preliminary draft. Check an editor of the accuracy of the information before publishing.

https://fortune.com/img-assets/wp-content/uploads/2025/09/GettyImages-2191364916-e1757081636439.jpg?resize=1200,600

Source link