The era of trilateral trade deals between Mexico, Canada and the United States is over, a veteran Mexican lawmaker says.

Deputy German Martinez CazaresA former member of the ruling Movement for National Renewal (Morena) party, he says the current agreement will not withstand pressure from nationalism pushed by the current US and Mexican administrations.

“We will see bilateral agreements between Mexico and Canada, and between Mexico and the United States,” Martinez Cazares told CBC News on Tuesday during a session of Mexico’s Chamber of Deputies, known as the Chamber of Deputies.

“We are entering uncertain territory.”

While the Mexican government, from President Claudia Sheinbaum to rank-and-file Morena deputies, has consistently stressed its commitment to an ongoing trilateral trade agreement, there is a growing sense among the country’s commentators that the United States is signaling an intention to change course.

Shortly after Martinez Cazares spoke with CBC News, US President Donald Trump, with Prime Minister Mark Carney sitting next to him in the Oval Office, indicated that he was open to making “different deals” with “individual countries” when a reporter asked him if he was committed to the current trilateral trade agreement.

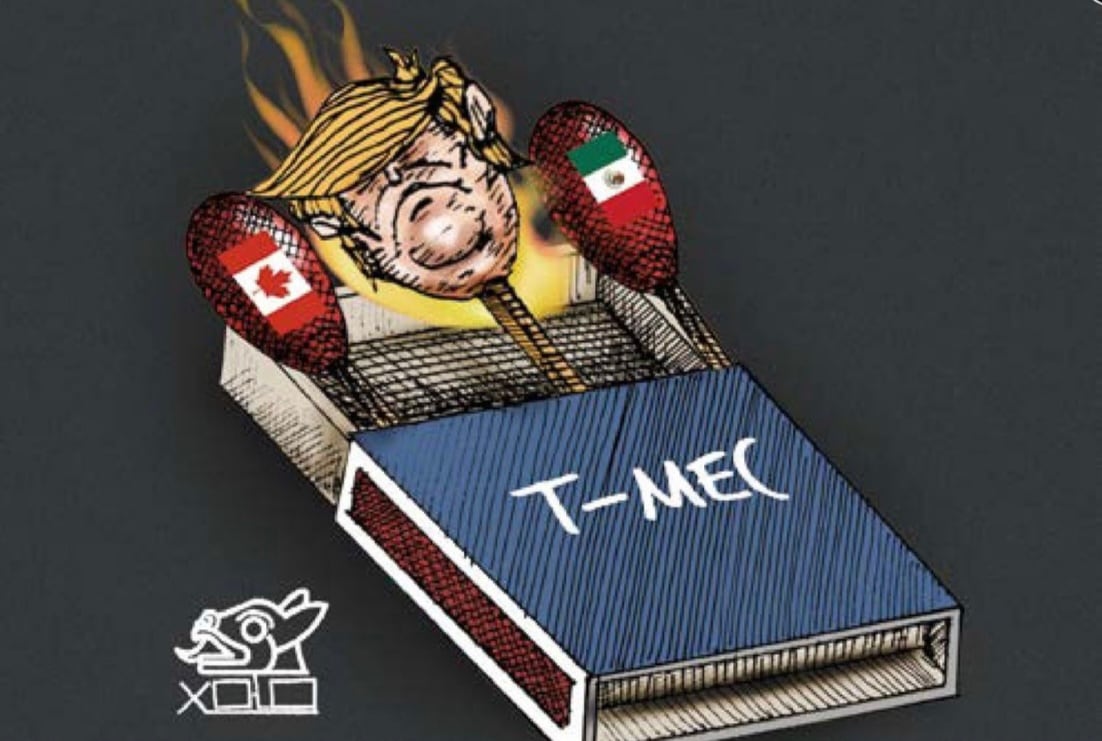

The comments made the front page of at least three Mexican newspapers on Wednesday, each using different headlines saying Trump had threatened to cancel the deal, known in Canada as the Canada-United States-Mexico Agreement (CUSMA), and in Mexico as Tratado entre México, Estados Unidos y Canada (T-MEC).

Trump’s words added fuel to the fire ignited by US Trade Representative Jamieson Greer, who last week He doubted the interest Of the deal – saying that the United States’ individual relations with Canada and Mexico were “so different… in so many respects” that one asked: “Why did we lump them together?”

The North American Free Trade Agreement (NAFTA) has stimulated investment

Minister of Foreign Affairs of Mexico Juan Ramon de la Fuente Ramírez faced a flurry of media questions about the issue Wednesday morning when he arrived for a hearing before the Mexican Senate. He reiterated the government’s support for CUSMA’s vision through the 2026 review process, and at one point mentioned Carney’s name.

“Prime Minister Carney was here not long ago. He also has the same perspective in favor of reviewing and renewing the trade agreement,” Mexico’s top diplomat said.

Carney visited Mexico in September to meet with Sheinbaum to strengthen bilateral relations.

Mexico was Canada’s third-largest trading partner, after the United States and China, in 2024, according to Canadian government data. Canada was Mexico’s fifth-largest trading partner during the same period.

The two countries recorded about $56 billion in trade in 2024, according to the data. That number has grown significantly since the signing of the North American Free Trade Agreement (NAFTA) in 1994, when trade between Canada and Mexico totaled just under $5 billion, according to federal government data.

Today, Mexico is an integral part of the automotive industry’s supply chain, exporting vehicles and parts across the U.S. and Canadian borders. There are more than 60 Canadian auto parts companies operating there, employing about 30,000 Mexicans, according to Canadian data.

Mexico also exports machinery, boilers, medical equipment, furniture, and products such as tomatoes, avocados, and guavas to Canada under CUSMA, while Canada sends propane, diesel, petrochemical products, seed oils, and wheat.

Export Development Canada has identified Mexico as a “priority market.” The country received about $46.5 billion in direct investment from Canada in 2024, a number that has grown steadily as a result of CUSMA, creating certainty and stability for Canadian capital.

Canadian companies also account for the majority of foreign dollars in the Mexican mining sector, while also investing about $10 billion in the energy sector.

In 1993, Canadian direct investment in Mexico amounted to just $3 billion, according to a report published by the Library of Parliament in 2024.

Mexico has become a more attractive option for expansion because of tariff threats from the United States, says Ottawa businessman Etienne Poisson, who founded Mechatronic Design Solutions.

The United States represents about 30 percent of Poisson’s business, which develops automated equipment for factories. It is currently CUSMA compliant and has avoided tariffs so far.

“There is still a fear that that will change, and since Mexico is part of CUSMA, I think it was the next logical place to come and do business,” Poisson said.

Poisson is promoting a range of industrial ovens that can be adapted to produce tortillas, grilled meats, flatbreads and cakes.

“I’m optimistic that, regardless of what happens to CUSMA, there will be a free trade agreement between Canada and Mexico,” he said.

Controversy over customs law

Martinez Cazares represents a region in the western state of Michoacán, which he says relies heavily on exporting agricultural products such as avocados, lemons and guavas to the United States and Canada.

He says the Sheinbaum government’s nationalist motives weaken its commitment to free trade.

“The walls are being revived,” he said.

Sheinbaum’s administration has recently faced attacks over a proposed comprehensive reform of the country’s customs system. The draft law seeks to modernize and tighten customs control and allow tracking of goods to confront corruption and tax evasion.

The opposition says it would actually make the border more dense, impose additional costs on importers and would contravene CUSMA by changing import rules midstream, while doing little to combat corruption.

“You can’t change the rules while a trade agreement is in effect,” said Rep. Patricia Flores Elizondo, a member of the Citizens Movement party and former chief of staff of Felipe Calder.OhN., who was President of Mexico from 2006 to 2012.

Representative Francisco Arturo Federico onVilla, spokesman for the Morena bloc in the House of Representatives, says the opposition attacks were only aimed at discrediting the government’s efforts to simplify the customs process and combat tax evasion schemes.

“The essence of (the law) is to reduce corruption, which was a sad symptom of the customs offices in our country inherited from (previous) governments,” he said. onvilla.

The bill is really intended to address U.S. allegations that Chinese products are being rebranded as Mexican to avoid tariffs, says Montserrat Aldave, chief economist at Mexican brokerage Finam. She says that if implemented correctly, it can improve trading.

“This could reduce some of the risks and strengthen Mexico’s position, not only in its trade relations with Canada, but also make the cross-border process safer and more transparent,” Aldev said.

While the proposed law places more accountability on customs brokers, it does not add any additional oversight to the Minister of National Defense, who was handed control of customs operations under the previous Morena administration of Andrés Manuel López Obrador.

“There are no mechanisms to control them,” she said.

The bill was approved in the Morena-controlled House of Representatives on Tuesday and is now before the Senate, which is also controlled by Morena and his allies.

https://i.cbc.ca/ais/8a4f28a0-d575-470a-90b6-98730d2ae82d,1760060741859/full/max/0/default.jpg?im=Crop%2Crect%3D%280%2C67%2C1280%2C720%29%3BResize%3D620

Source link