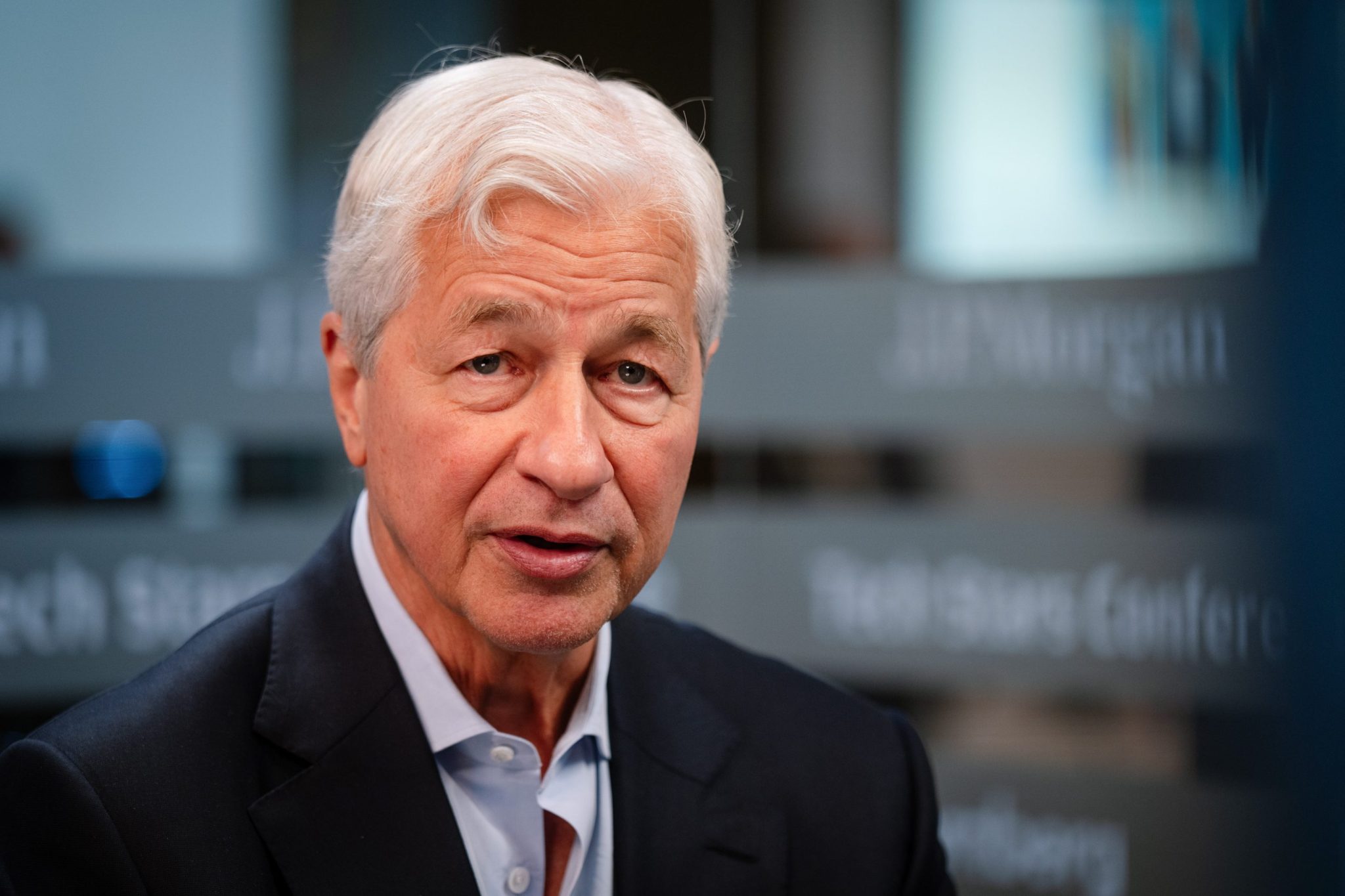

Jamie Dimon, CEO of the world’s most valuable bank and the architect of the “fortified balance sheet” that helped JPMorgan emerge unscathed from the 2008 financial crisis, believes investors are underestimating the risk of a major market correction — one that could knock down stocks by about a third.

With stock market valuations and concentration at record levels, some prominent tech leaders are loving it OpenAI CEO Sam Altman As well as institutions such as the Bank of England to caution About churn in the market and the possibility of that The AI bubble may burst soon. Dimon, who during his two decades at the helm of JPMorgan built a reputation for acting cautiously and making smart business moves such as the JPMorgan buyout. First Republic Bank In 2023, he warns that the stock market is not pricing deflation risks appropriately.

“I worry about it a lot more than others,” Damon told the newspaper. BBC In an interview published Wednesday. “I would give a higher probability than I think it’s probably priced in the market and by others. So if the market is pricing at 10%, I would price it at — I would say closer to 30 (percent).”

In his latest statements, Dimon said that it is difficult to predict the timing of the end of the rise. A stock market decline could occur within six months. He pointed out that the stock market rise may continue for another two years.

“Bull markets can last a lot longer than you think,” he said.

The JP Morgan CEO said he has studied other periods of market euphoria such as the dot-com bust, and found that the only way to know when a bubble is nearing its end is through high valuations, otherwise: “It’s really impossible to know when a bubble will burst.”

He acknowledged that valuations are high by many metrics, creating an element of risk. Part of what has led to this situation is the influx of cheap money into the markets in recent years thanks to The national debt ballooned Used to stimulate stimulus as well as quantitative easing during the coronavirus pandemic.

Dimon added that some investment in AI will “most likely” be a waste of money, and some investors in the technology may end up worse off.

“AI is real,” Damon said. “AI in the grand scheme of things will come to fruition, just like cars in the grand scheme of things, and television in the grand scheme of things.” “But most of the people involved didn’t do well.”

The current AI-fueled optimism has sent the S&P 500 index higher 33 records in 2025just below the 57 record high set in 2024 with three months remaining in the year. In terms of stock concentration, the 10 largest companies in the S&P 500 now make up a record 40% of the index’s market capitalization. The S&P 500 is up about 14.8% year-to-date through Thursday.

https://fortune.com/img-assets/wp-content/uploads/2025/10/GettyImages-2239332959_555226-e1760025248996.jpg?resize=1200,600

Source link