Liz Ann Sonders, the chief investment strategy in Charles Schwab and Co., analyzes the consumer price index report in January about “earning money”.

A more hot inflation report than January and the uncertainty about the president’s influence Donald Trump Economists experts said that the customs tariff plans for consumer prices could affect the decision to reduce the Federal Reserve.

On Wednesday, the Ministry of Labor issued a consumer price index (CPI) for January, which showed that inflation was 3 % on an annual basis, an increase of 2.9 % per month, after a monthly increase greater than 0.5 %.

the High inflation It comes after the Federal Reserve chose to reduce the fourth consecutive interest rate at its meeting last month. Understanding surrounding Trump’s tariff plans, which are taxes on imported products, and their implementation schedules can lead to longer waiting for the prices to reduce more than expected.

“Today’s data confirms that Powell’s decision to put price discounts on the rear stove for a long period of time,” said Charlie Ribli, the chief investment strategy in Allianz Investment. “In general, the inflation data today must force the market to rethink the ability of the Federal Reserve to reduce prices this year, especially given that the high prices are not related to any introductory activity from the White House.”

Inflation rises by 3 % in January, and more hot than expected

Bill Adams, chief economist at Komerica Bank, said that hot inflation pressure is “a confirmation that price pressures continue in the bubble under the surface of the economy” and will “will strengthen the federal reserve bank to at least discounts in the slow -end rate and perhaps even in 2025.”

“The Federal Reserve monitors an impact A higher tariffAdams added: “These policies may add inflation as their effects are crowned through the economy, which caused the interest rates to increase the high interest rates than it was in the current situation.”

Federal Reserve Chairman Jerome Powell said that the Federal Reserve is awaiting to know how to implement customs tariff policies before calculating any inflationary effect. (AFP via Gettty Imagesges / Getmages)

Sima Shah, chief international strategic expert in the management of the main assets, said that the inflation report “will make the uncomfortable reading for the federal reserve” given the growth growth and note that “the government’s policy agenda threatens inflation expectations” – a dynamic that can lead to inflation risk To become “very likely to the bullish direction to allow the Federal Reserve to reduce prices ever this year.”

Gregory Daco said that his company’s view is that the Federal Reserve “will maintain the waiting and vision approach in the coming months” and that he currently only sees discounts in interest rates in June and December. “The risks are less than reduced if the management policy mixture is nourishing inflation and inflation,” Daco said.

Trump bombings are fueled by not to reduce interest rates

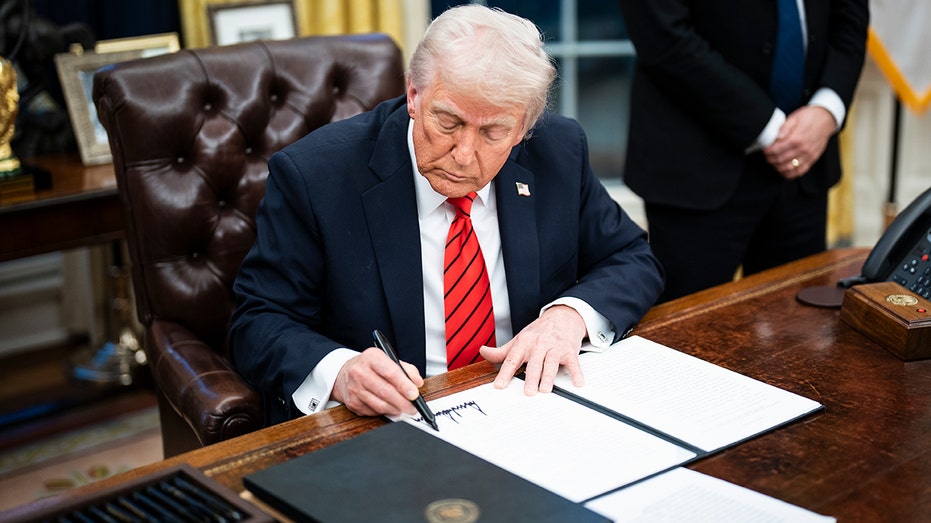

President Donald Trump imposed a new tariff on China and threatened the tariffs on Canada and Mexico, as well as the mutual tariff for other commercial partners. (Jabin Botsford / The Washington Post via Getty Images / Getty Images)

Ryan Sowet, the US chief economist in Oxford Economic, pointed out that the additional Definitions on China And other threatened definitions “still on its way to inflation data.”

Sweet said: “The response of the Federal Reserve to the definitions is not clear, but we do not believe that the most strict monetary policy is likely to inflate the economy from the customs tariff.” “The Federal Reserve needs a time to measure how the definitions affect both sides of their double mandate, which makes it paralyzed until December, when we believe that its attention will turn from inflation to its full mandate, which leads to aggressive alleviation in 2026.”

“The effects of monetary policy are clear, but it is not clear whether the consumer price index in January will give some in the Trump administration a pause to move forward quickly with some proposed definitions. It is still possible to use definitions as a tool for bargaining to obtain some concessions from countries Others, he explained that the political optics of pressure on consumer prices on consumer prices through the definitions will not be large for the Trump administration.

Get Fox Business on the Go by clicking here

Federal Reserve Chairman Jerome Powell He witnessed before the Financial Services Committee in the House of Representatives on Wednesday, and was asked about the impact of definitions on the cost of living for the Americans and the efforts of the Central Bank to tame inflation, and the president indicated that the Federal Reserve does not comment on policy decisions who have discretionary authority.

“Federal Reserve Bank “There is no role in setting customs tariffs, as you know, we do not comment on the decisions taken by those who have this power. We are trying to stick to our love. In this particular case, the economy can develop in ways due to the customs tariff, or partially Because of the customs tariff, which we will need to do something through our policy rate. But we cannot know what we really know the policies that are enacted. “

https://a57.foxnews.com/static.foxbusiness.com/foxbusiness.com/content/uploads/2024/09/0/0/Federal-Reserve-Chair-Jerome-Powell-press-conference.jpg?ve=1&tl=1

Source link