Good morning. It is based in New York City textureParent of Luxury Brands Coach and Kate Spade New York implements a three -year strategy that focuses on profitable growth and strong shareholders ’revenues.

The “amplify” strategy is installed on four columns: building emotional connections with consumers (especially Gen Z), progress in innovation, providing convincing global experiences, and promoting a flexible culture that focuses on consumer.

These priorities depend on proven strategies, especially in the coach, according to the financial manager and the director of operations Scott Row, who spoke to me on Tuesday before the company’s investor day.

The millennial generation and General Z is increasingly chosen, and they lead a rhythm For a quarter Which ended on June 28, fueled by this demographic composition. “By 2030, Gen Z and Millennials will make up more than 70 % of the market,” said ROE. TAPESTRY aims to capture the first luxury purchase.

“The long -term value for customer acquisition at this initial entry point is great,” he said. “While others speak to millions, we are talking to billions of potential consumers.”

In the same quarter, TAPESTRY reported a non -cash weakness of 855 million dollars related to Kate Spade and a 13 % decrease in the brand, luck I mentioned. Nevertheless, after achieving previous goals, the company is confident that its strategy can push the future growth of both the coach and Kate Spade.

TAPESTRY plans for the coach to provide annual growth in the middle of the number (CAGR) and expand its operation margin to the mid -30 % range over the next three years, with a long -term goal is to reach $ 10 billion in annual revenues.

The company expects that Kate Spade will return to the profitable upper growth in 2027 and the goal of revenue growth in the middle of the middle number and the margin of operating consisting of number one by 2028.

“The size and investment in marketing was not more important,” Roo confirmed. “There are no obstacles to entering our category, but great obstacles to the range.” Over the past three years, the TAPESTRY marketing investment has grown from 3.5 % to more than 11 % of revenues, with plans to increase it by 200 other basis points.

Row said that TAPESTRY plans to return 4 billion dollars to shareholders by the fiscal year 2028, which represents 100 % of the free cash flow modified from the 26th fiscal year to the 28th fiscal year, even after capital expenditures. He said that the company is now working with a sustainable growth rate in the middle of the number, driven by a self -reinforcement model that focuses on quality growth and margin expansion.

This performance allows a major investment at work, which led to strong profits and cash flow, Row said. The priorities for allocating capital include increasing profit distributions (targeting a 30 % payment rate), sharing shares recently, and returning all free cash flow to shareholders.

“This is a strong message that really reflects our conviction in the future,” said Row.

Sherrill Istra

[email protected]

Leaders

Fortune 500 power moves

Rangith Roy He was promoted to Yum Financial Director! Trademarks (No. 491), The parent brands company with home names including KFC, Taco Bell and Pizza Hut. Roy holds a position Chris TurnerIt was actually promoted to the CEO, on October 1. Roy joined Yum! In 2024, as the chief strategy and secretary of the Fund, overseeing strategy, integration, acquisition and treasury operations. Before joining Yum! He held the position of financial manager of the Goldbely e -commerce market, where he helped expand the scope of operations. He also spent more than 15 years with Goldman Sachs, as he led the investment banking relations of restaurants, food and food technology companies, and building experience in industry.

“A mixture of commercial acumen and the strategic insight on Yum!” Said Turner at A. , And restaurants industry. statement. “It has the ability to move in fast and complex environments with a sharp focus on creating value in the long run.”

Every Friday morning, Fortune 500 Fortune 500 column transformations–See the latest version.

A big deal

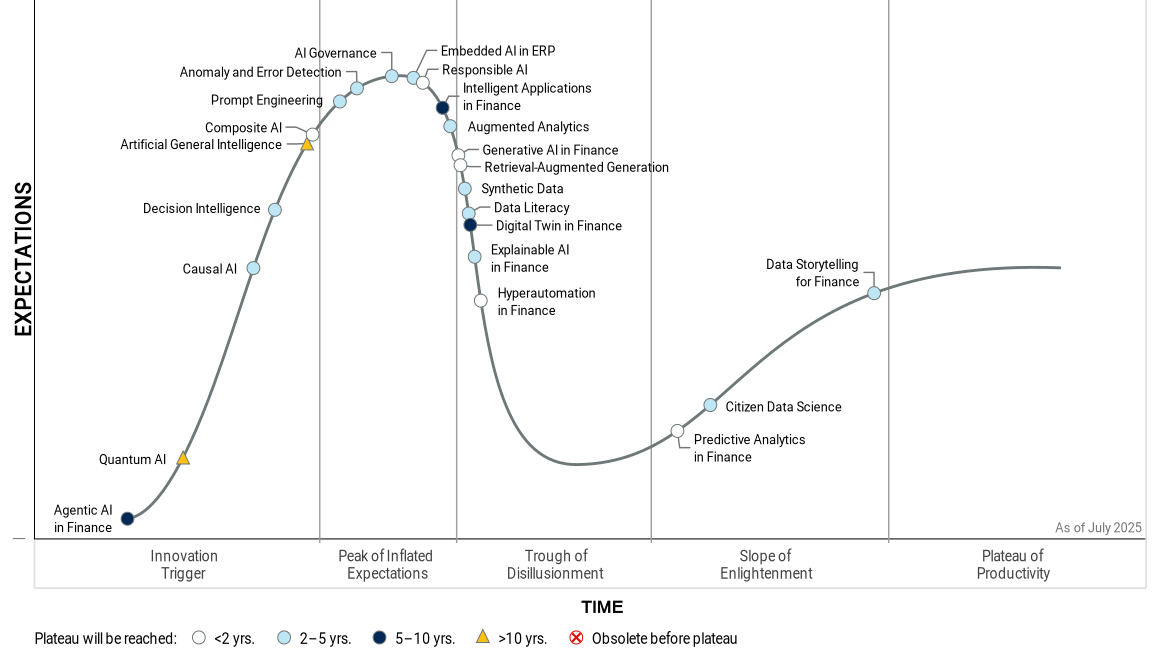

The financial manager is wrestling with the size and speed of artificial intelligence developments in companies financing, according to Gartner Inc. , It is a business and technology company.

“The pace and capabilities of artificial intelligence in financing can be overwhelming,” said Alex Levin, director of finance exercise in Gartner, in a statement. “Artificial intelligence in the financial noise cycle aims to help financing leaders overcome noise and focus on technologies that are likely to have a greater effect in the near term.”

Below The noise cycle in Gartner for AI in financing, 2025

deepen

From the report: “Karl Ishinbach, CEO of the 62 billion dollars of working day, reveals that Gen Z’s job success will not come from chasing titles or resuming the filling-but by converting their mentality. He says instead, he says that Gen Z should double the positions, originality and relationships to flourish in the workplace that was cut by Amnesty International.” You can Read the full report here.

Hearing

“This really helped me during some difficult times, as he was diagnosed with hyperactivity disorder and lack of attention, and my help in slowing my thoughts and be more strategic.”

https://fortune.com/img-assets/wp-content/uploads/2025/09/GettyImages-2148351770.jpg?resize=1200,600

Source link