German bank Analysts were watching Amazon Permis, apparently. Specifically, the “penetration” offer for the summer, “the summer to which it has turned.” In the field of artificial intelligence, analysts Adrian Cox and Stephen Perodan wrote that it was Amnesty International Summer “Once Ugly”, with many emerging topics that will put the session for the last quarter of the year. Among them: The increasing fear About whether artificial intelligence has pushed large technology shares to a kind of excessive land that precedes a sharp decrease.

Summer Intelligence News Agency has acquired topics including the challenge of starting a profession, the importance of technology in the trade war in China/United States, and anxiety about technology effect. But with regard to financing and investment, Deutsche Bank sees the markets “on the edge of the abyss” and hopes to get a soft landing amid bubble fears. In part of it, he blames the executives of technology in eggs on the market with excessive blades, leading to amplified hopes and dreams, as many were pushed by excessive technology leaders. It also sees a major impact on the area of investment capital, which enhances the evaluation of startups, and one of the lawyers who are very busy providing lawsuits for all types of artificial intelligence players. It is ugly there. but The German bank says that the market is “more realistic” in fact in several ways of the situation in the late 1990s.

However, Wall Street is not a major street, and Deutsche Witches observed the worrying mathematics bank about data centers that run out to the outskirts of your city. Specifically, the bank announces a rear analysis of the Partian Capital Harvesting Funds, which indicates that the investments of the huge data center in the hyperemalist can prepare the market for negative returns, echoing the “capital destruction” courses.

The noise of artificial intelligence and the fluctuation of the market

Artificial intelligence seized the market imagination with “It is clear that there is a lot of noise.” The bank said that the searches on the web for artificial intelligence Google Trends data, while you also find that S&P 500 mentioned “AI” more than 3300 times in its profit calls last quarter.

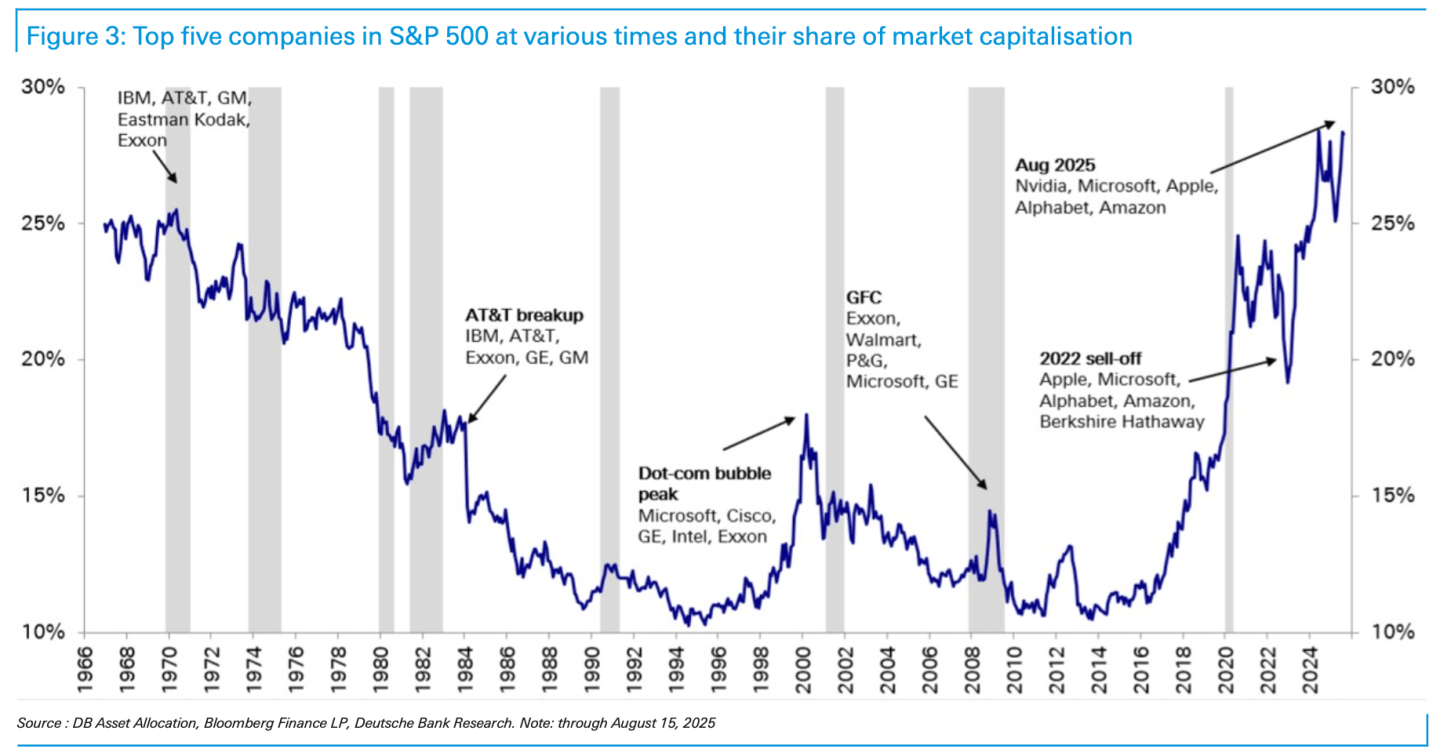

The stock evaluations in general increased alongside “Seven Great” Technology companies, which include a third of the S & P 500 market. (The most wonderful: NafidiaNow the most valuable company in the world in the maximum market exceeding $ 4 trillion.) However, Deutsche Bank indicates that the best technology players today have more healthy explanatory budgets and more flexible business models than high fennel in the Dotcom era.

According to most of the percentages, the bank said, the assessments “still seem more realistic than those in hot stocks at the height of the point bubble”, when they are Nasdak More than three times in less than 18 months to March 2000 doubled, then lost 75 % of its value by late 2002. According to the price rate to profits, the alphabet, Dead In the mid -20x range, while Amazon and Microsoft Trade in the mid -30x range. In comparison, Cisco 200x exceeded the Dotcom bubble, and even Microsoft reached 80X. Notice Nafidia “only” 50x, and Deutsche Bank indicated.

These data centers, though this

Despite the relative restrictions in stock prices, the real risks of AI may lie in wait for the stock market evaluations, in its infrastructure economics. Deutsche Bank is martyred Blog published by Brighturian Capital “This was doing tours.” Published in “Kuppy’s Korner“Kupperman”, “Kupperman”, and is estimated that the total spending of the two centers on excessive data in 2025 may reach 400 billion dollars, and the bank notes that it reduces the size of the gross domestic product every year, while it wanders every year, while it wanders every year, while it wanders every year. No more than $ 20 billion of annual revenue. How is it supposed to do this?

“Now, remember that the revenues today are working at $ 15 to 20 billion dollars,” says The Blog Post, explaining that the revenues need to grow at least ten times to cover consumption. Even assuming that future margins rise to 25 %, the publication of the blog is estimated that the sector will require amazing annual revenues of $ 160 billion of artificial intelligence backed by these data centers only to break even consumption – and about $ 480 billion to provide a modest return of 20 % on the invested capital. For context, even giants are like Netflix And Microsoft Office 365 in their peaks brought less than part of this number. Even at this level, “you will need $ 480 billion of artificial intelligence revenues to strike your target return … $ 480 billion is a lot of revenue for men who do not pay monthly fees today for the product.” The transition from $ 20 billion to $ 480 billion can take a long time, if any, is the implicit meaning, and at some point before the big artificial intelligence platforms reach those levels, it can take its profits, and it is assumed that its shares may achieve great success.

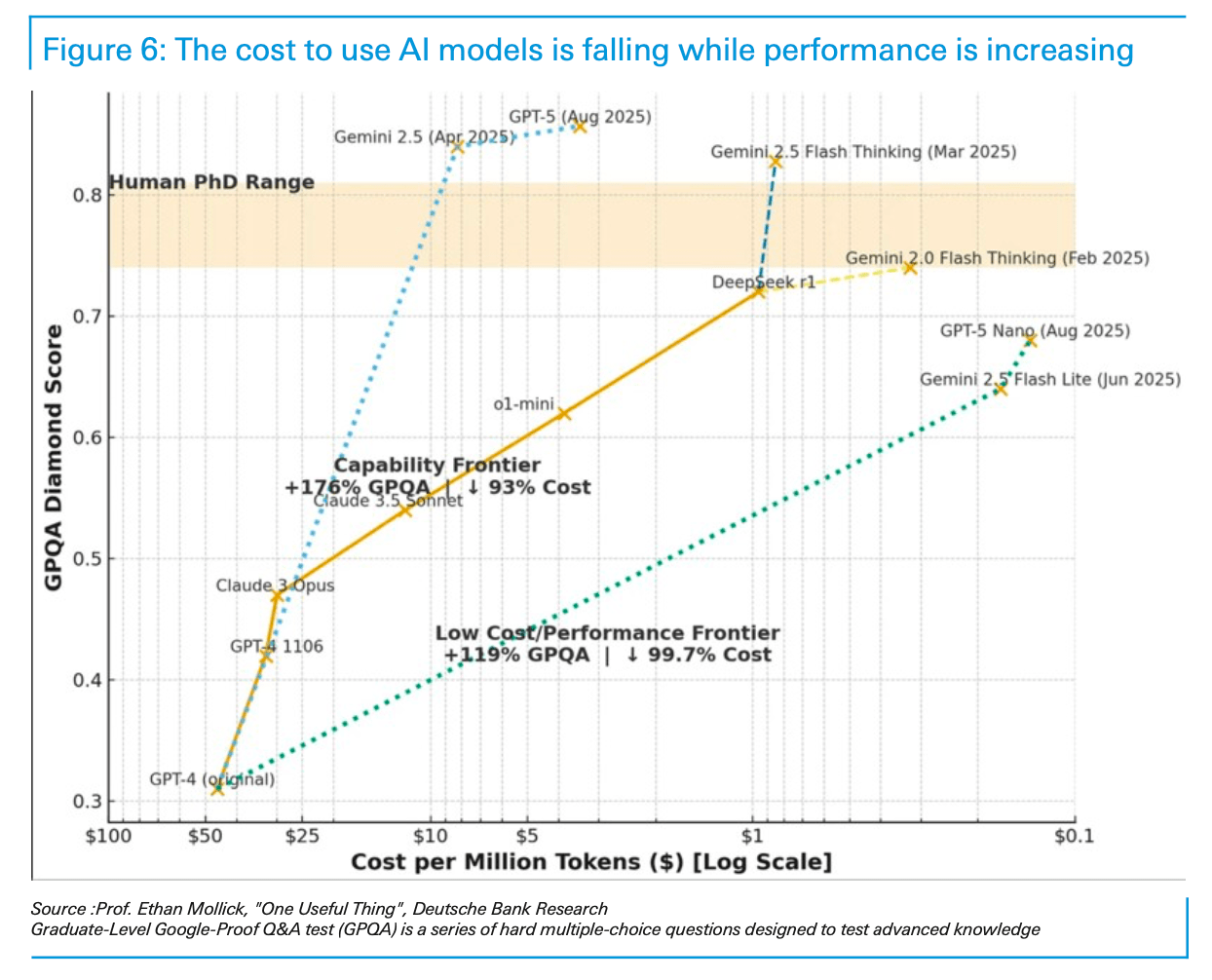

Deutsche Bank itself is not pessimistic. The bank notes that building the data center produces a significantly reduced cost for every use of the artificial intelligence model, as startups reach a “meaningful measure in cloud consumption”. Also, AI consumers like ChatGPT and Gemini quickly, where Openai said in August that Chatgpt had more than 700 million weekly users, as well as 5 million users of business, an increase of 3 million three months. The cost of inquiring about the artificial intelligence model (which is supported by the investment capital sector, definitely decreased by 99.7 % in the two years since the launch of ChatGPT is still heading down.

Echoes of the previous bubbles

Praetorian Capital draws two historical similarities to the current situation: building fiber in the Dotcom era, which led to the bankruptcy of the global crossing, and the most modern capital process of oil rock oil. In every case, the latent Technology is real and transformational – but excessive spending on the realization of a few returns can let investors carry the bag if as for the progress period.

The “armament race” mentality that is now sweeping in building a huge Capex of equivalents reflects the intensity of the capital for these previous crises, and as Praetorian notes, “even Mag7 will not be fortified” if it runs out the patience of the shareholder. For each Copy from Kobe, “MEGACAP technology names are forced to continue to buy chips, after exceeding their cash flows; or it abandons the arms race, and crosses out in the past few years of Capex … like many things in financing, all this is completely clear where the matter will end, it’s the timing that is the difficult part.”

Deutsche Bank argues that this course, Strong profits and more conservative assessments than the Dotcom eraBut “periodic corrections are welcome, and the release of some steam from the system and the guardianship of self -consent.” If the growth of revenue fails to keep abreast of consumption and replacement needs, investors may force investors – one that is not characterized by amazing innovation but by slowing the negative returns.

https://fortune.com/img-assets/wp-content/uploads/2025/09/GettyImages-2233719278-e1757020276322.jpg?resize=1200,600

Source link