(This is Warren Buffett Watch’s newsletter, news and analysis on all things Warren Buffett and Berkshire Hathaway. You can subscribe here To receive it every Friday evening in your inbox.)

Berkshire’s Japanese stock is worth $30 billion

The total value of the Japanese five”Trading houses“At Berkshire Hathaway Stock portfolio The value of its shares has surpassed $30 billion in recent weeks, and it appears that Warren Buffett is still buying them.

Berkshire had already been building up its positions for twelve months when Buffett initially disclosed the risks By about 5% each on August 30, 2020, his 90th birthday.

At the time, the total value of the five positions was approximately $6.3 billion.

Today it’s up 392% to $31.0 billion, with Berkshire buying more over the years and shares up between 227% and 551%.

The total may be higher because some additional purchases may not have been disclosed yet.

We know that Warren Buffett has been adding to what was already a hugely successful investment, with the recent public admission that two of his stakes exceeded 10%.

one of the two, Mitsuidetailing this week exactly how many shares Berkshire owns.

In a press release On Thursday, the company relayed word from Berkshire that its National Compensation subsidiary owned 292,044,900 shares as of September 30.

At Friday’s close, its value was about $7.1 billion.

The company’s stake is 10.1%, making Nation Indemnity its largest shareholder.

This is also an increase of 2.3% from 285,401,400 shares, or a 9.7% stake, Reported in March.

This week’s press release is a follow-up to One was released two weeks ago Before Mitsui said that She was “informed” by Berkshire They “now own 10% or more of Mitsui’s voting rights,” but were not told the exact number of shares Berkshire owns.

In late August, Mitsubishi I mentioned Berkshire informed it that its stake had increased to 10.2% from 9.7% in March.

We haven’t heard anything since March about Berkshire’s other three Japanese holdings. Itochu, Marubeniand Sumitomobut it will not be surprising to know that these risks have also exceeded 10%.

Back in 2020, Buffett promised companies that he would not raise Berkshire’s stakes more than 10% without permission.

In his country Annual letter to shareholders However, Buffett wrote in February: “As we approach this threshold, the five companies have agreed to moderate the cap.”

As a result, he said:over time“You are likely to see Berkshire’s ownership of all five companies increase to some extent.”

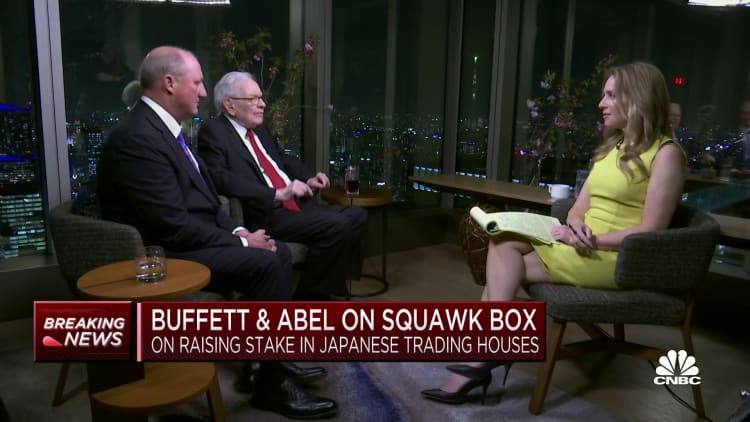

In 2023, Buffett told CNBC’s Becky Quick: He was first drawn to stocks in 2020 because “they were selling at a price I thought was ridiculous, especially the price compared to prevailing interest rates at the time.”

this year, He told shareholders Berkshire will hold on to them for “50 years or forever.”

Buffet around the internet

Some links may require a subscription:

Highlights from the archive

Why Buffett and Munger Don’t Trust Financial Forecasts (1995)

Berkshire stock monitoring

Berkshire’s Top US Holdings – October 10, 2025

Berkshire’s top holdings of publicly traded stocks in the US, Japan and Hong Kong, by market cap, based on today’s closing prices.

Property as of June 30, 2025, as stated in Berkshire Hathaway Files 13F On August 14, 2025, except for:

The complete list of properties and current market values is available at CNBC.com Berkshire Hathaway Portfolio Tracker.

Questions or comments

Please send any questions or comments about the newsletter to me at [email protected]. (Sorry, but we don’t send any questions or comments to Buffett himself.)

If you are not already subscribed to this newsletter, you can subscribe here.

It is also highly recommended to read Buffett’s annual letters to shareholders. There it is collected Here on the Berkshire website.

— Alex Crippen, Editor, Warren Buffett Watch

https://image.cnbcfm.com/api/v1/image/45387784-Warren-Buffett-japan-2-200.jpg?v=1354391709&w=1920&h=1080

Source link