Congress Budget Office (CBO) re-estimated the 10-year budget expectations, and they raised the foundation line of taxpays by $ 1.9 trillion.

This is the same outfit that for years told us that low tax rates always reduce tax revenues and increase budget deficit. But wait for a moment: The tax cuts in Trump 2017 were valid for more than 7 years. Will the Omani Central Bank suggest that they were wrong all the time by admitting that the Lavir curve is really working? and Low tax rates Have produced higher tax revenues? This is what their new expectations seem to say.

In fact, since the President of Trump’s tax rate in corporate tax rate reduced from 35 % to 21 %, over the past seven years, corporate tax revenues have multiplied mainly. Indeed, low personal income taxes and other measures supporting growth, the entire federal tax revenue base increased by about 50 %. How in the world can the Central Bank of Oman return to the right and now it says that if Trump’s tax cuts are extended, the cost of 10 years will be 4 trillion dollars? What? There is no cost.

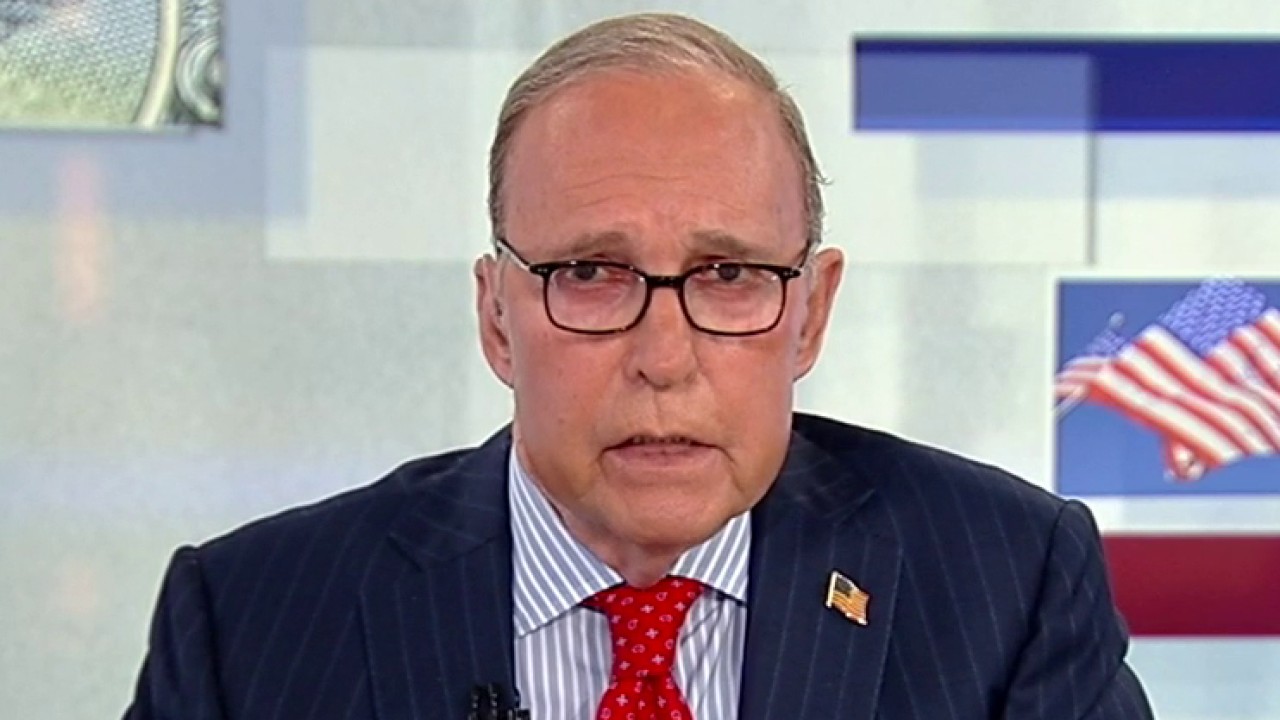

US Treasury Secretary, Scott Beesen, is overseeing the tariff of power in global negotiations on “Kudlo”.

Maintaining low taxes and revenue will remain high. There will be less tax avoiding and better growth. LaFFer has been right for approximately 50 years. The Central Bank of Oman was mistaken for about 50 years. Here they go again, trying to tell us that the extension of Trump tax cuts will increase the budget deficit by $ 4 trillion because the revenues will be less.

It is absolute nonsense and Republicans in the House of Representatives, the Senate and the White House must fight this nonsense. Until now, one of the fighters was Senator Mike Krabo (PBUH) of the state of Idaho – who still argues that if you only extend the current law, we will not raise taxes or reduce taxes. There is no new deficit of $ 4 trillion. But if the tax bill is not extended, you will get a tax height of $ 4 trillion and this will increase over time the budget deficit is worse. Mr. Crabo calls it the current policy and hopes that the Republicans will fight to formally change the budget rules.

Senator Mike Crabo, R-Daho, separates the tax and definitions law under President-elect Donald Trump on “Kudlo”.

There is a precedent. In 2012, Congress and President Obama extended the tax cuts of George W. Bush using the current policy argument that assumed that Bush’s tax cuts would continue – endless. Mr. Crabo has repeatedly said that the Central Bank of Oman does not record an increase in permanent spending with long -distance walking every year – and therefore they should not record a permanent tax increase. Otherwise, the entire federal financial system is similar to the ball machine and pins on the permanent inclination: it always enhances high taxes, high spending, and even high deficit.

Republicans must work hard to reduce unnecessary federal spending and not to influence. They must reduce Government size and scope. But if they allow the end of the tax cuts, they will find themselves with a terrible economy and a higher deficit at the same time.

It is a loss loss.

Mr. Trump said that we should not get tired of winning. Let’s start Trump tax cuts extension And the development of the economy by 3- or perhaps 4 % per year.

We call it blue collar.

https://a57.foxnews.com/static.foxbusiness.com/foxbusiness.com/content/uploads/2024/05/0/0/Larry-Kudlow-Biden-wont-do-a-thing-about-this.jpg?ve=1&tl=1

Source link