FOX Business’ Cheryl Cassone joins FOX & Friends First to discuss the insurance crisis in California as wildfires devastate Los Angeles and broader concerns about the industry’s progress.

the Deadly forest fires The storm that struck Southern California this week destroyed a large number of homes after some leading insurance companies backed away from offering policies in the Golden State in recent years due to the high risk of wildfires as well as the difficult regulatory environment.

Several ongoing wildfires, including the Palisades Fire and Eaton Fire, have devastated communities in Los Angeles areaincluding Pacific Palisades and Altadena. The fires burned nearly 30,000 acres amid Santa Ana winds, with evacuation orders issued for at least 130,000 people in the area. The fires killed at least five people and destroyed more than a thousand buildings.

State Farm, California’s largest home insurer, announced in March 2024 that it would stop covering 72,000 home and condo insurance policies in the summer. The company cited inflation, regulatory costs and increased disaster risks for its decision and had previously stopped accepting new applications in the state.

Several other leading insurers, including All State, Farmers and USAA, have also in recent years restricted new insurance claims in California as part of an effort to limit their exposure to policies that carry what they view as undue risks given what state regulators have allowed. them to charge policyholders. Similar reasons of escalation of risks, high repair costs, and high reinsurance premiums were cited in those decisions.

Plumes of smoke were seen as wildfires burned in Pacific Palisades, California, on Tuesday. (David Swanson/AFP via Getty Images/Getty Images)

This week’s wildfires have drawn new attention to the issue of insurers stopping new policies or refusing to renew previous policies in California communities at high risk for wildfires, with prominent entertainment industry figures calling for action in the wake of the disaster.

James Woods, the actor who owns a house in Southern California The area burned by the Palisades Fire wrote on X that “one of the major insurance companies (sic) canceled all insurance policies in our area about four months ago.”

Actor Rob Schneider criticized State Farm in a post on

“Our first priority now is the safety of our customers, agents and employees affected by the fires and assisting our customers in the midst of this tragedy,” a State Farm spokesperson said in a statement to FOX Business.

State Farm cuts 72,000 California home insurance policies: ‘Decision was not made lightly’

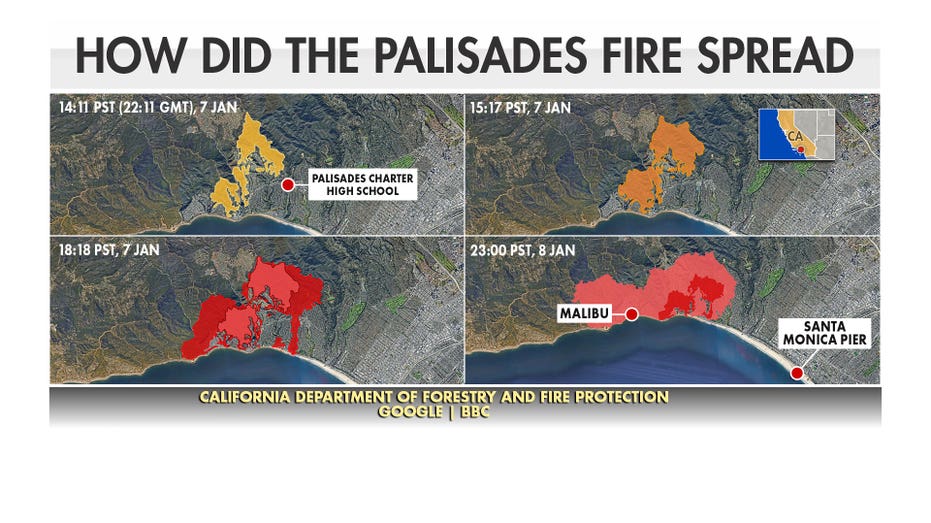

The spread of the Palisades Fire has been mapped. (Fox News)

condition California home insurance market It has suffered in part because of regulatory limits on what companies can charge policyholders in premiums, as well as increased exposure due to wildfires and other extreme weather events that have caused payouts to rise and strained the reinsurance market.

California voters approved Proposition 103 in 1988, which was intended to protect policyholders from unfair increases in interest rates by requiring insurers to obtain approval from the California Department of Insurance for any increases exceeding 7%. The law also sets a cap on interest rate increases and spreads any increases over three years.

California wildfires prompt scrutiny of federal and state rules hindering mitigation efforts

Firefighters battle flames caused by the Palisades Fire in the Pacific Palisades neighborhood of Los Angeles on Wednesday. (Abu Gomez/Getty Images/Getty Images)

While insurers can get approvals for larger increases — State Farm got a 20% increase in home and auto premiums in January 2024, and then requested a 30% increase in home insurance policies last summer — they can The process takes a long time and is large. Interest rate increases approved by the regulator may not be enough for insurers to continue offering policies while maintaining their policies Financial stability.

By limiting insurers’ ability to raise interest rates to account for increased risks, they keep insurance plans artificially low for consumers. This means that insurers face a decision between keeping this excess financial exposure on their books, taking steps to reduce their exposure, or leaving the market.

California offers a so-called FAIR plan as an insurer of last resort for consumers who have been unable to secure a plan in the private market. However, policies remain expensive and insurers raise concerns about the sustainability of FAIR plan growth.

Get FOX Business on the go by clicking here

The FAIR Plan’s exposure rose $174 billion, or more than 61%, from September 2023 to September 2024, when its residential exposure reached $458 billion. The number of housing documents in place under the FAIR plan rose from 320,581 to 451,799 in that period, while it has increased by 248,902 or 123% since September 2020.

“The FAIR Plan continues to grow in size as consumers find themselves without coverage. As a result, we have doubled in size in the past three years,” FAIR Plan President Victoria Roach said at a hearing in March. “As the numbers rise, our financial stability becomes more in doubt.”

https://a57.foxnews.com/static.foxbusiness.com/foxbusiness.com/content/uploads/2025/01/0/0/southern-california-wildfires.jpg?ve=1&tl=1

Source link