By the beginning of this year, the world’s leading United States, the United States, grew the ability to charge nearly 100 million metric tons of LNG every year – unbearable rapid growth for the American industry that began to export a decade ago.

By 2030, an unknown startup is expected to exceed the Venture Global, this size alone. Shipping started only three years ago. Venture Global oil and gas strangers do so by raising project design standards, which disturbs the hierarchy of large oil, and dominates the emerging gas export industry.

Natural gas export works – must be shipped abroad in the tankers – have been taken off thanks to the continuous nation Glue rock mutationThe growth needs of the world’s growing strength, and the desire to rely be less on Russian gas. LNG (LNG) is the largest sector of US oil and gas growth, and it responds to the gas demand more than Even the booming artificial intelligence data center Increased construction. From only 2024 to 2028, the ability to export LNG in North America must be more than twice, according to the US Department of Energy.

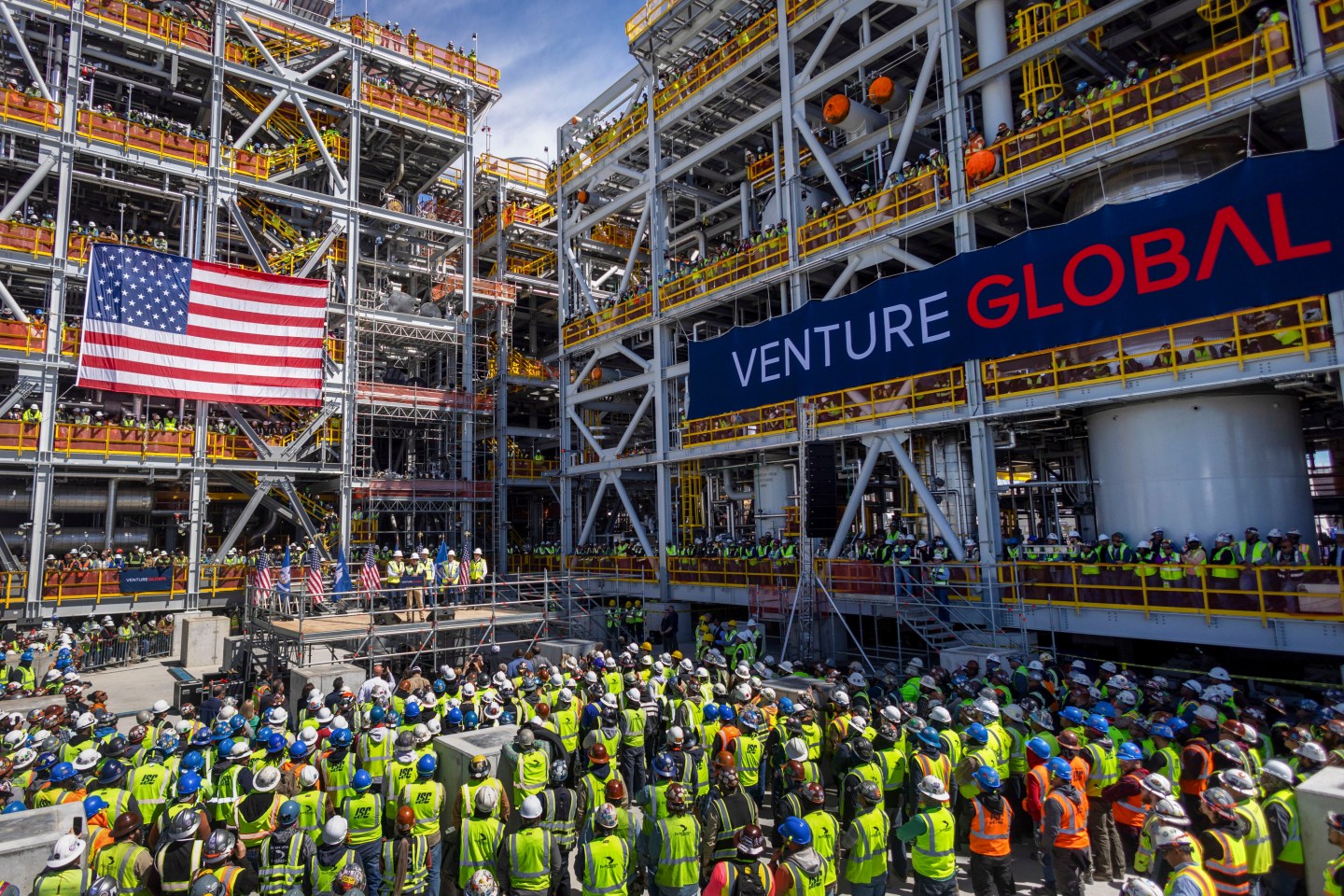

Venture Global growth is amazing. Its speed was shocked almost every industry analyst. It does not have slow plans during the early thirties. Even the founder and CEO Mike Sable is surprised by its construction: The company has exceeded its expectations in time tables and productive ability. It is not bad for a company founded by leaders with only auxiliary energy experience.

Sabil told luckHighlighting the headquarters of the Venture Global’s Arlington, Ferjenia away from the Energy Epicient Center in Houston. “We were far from view and mind.”

Now, Venture Global goes quickly to bypass the pioneers and leader of LNG in the United States Cheneree Energy At the capacity before the end of the contract, Sabel and the analysts said.

It is built with the joy of “Disruptor”, Venture Global has grown despite the inconvenience of industry. A large oil giant coincidence Accused of global risks of deception – not turmoil – in a dispute over the contract. In a preliminary public offer in principle early this year, the company sought to obtain a market evaluation approaching $ 110 billion-surpassing Chenere-during his riding pro-boundar fuel, Trump’s opening wave-only to sink the market ceiling to $ 17 billion in early April.

However, Venture Global won the arbitration battle against Shell in August. coincidence, BPAnd others accused the Venture Global of profit in the sales of goods before fulfilling their long-term contracts-and stocks have doubled more than twice since their lowest level, and raised them to the maximum market exceeding $ 36 billion.

“We are following the path of turmoil in many industries. First, you are ignored. Then you are ridiculed by job occupants and those who criticize people with new ideas.” “After that, when you start influencing job occupants, they defame you, which is the stage in which we are now. In the end they discover that they are losing, and they are trying to know how to compete.

The main discrimination in Venture Global is building smaller LNG facilities – controlling “trains” – in its huge factories in the Gulf coast in Calcasieu Pass and Plaquemines in the southwest and southeast of Louisiana, respectively. While the opponent may build four huge trains, the new Plaquemines in VG will soon calculate 36 standard trains upon completion.

Sabel said that these cost facilities can come on the Internet more quickly, one by one, while construction continues, and revenue flows are operating faster. “This was so much about realizing that we have developed a new way to do this, and that it changes the competitive scene.”

Energy analyst Jack and Axel, from East Dali, said that Ventaur Global explains a “remarkable shift” from the starting start and arbitration issues in Calcasieu Pass, as well as the temporary organization of the president of the president last year.

“They look a lot about this like the assembly line,” Wixel said. “They were somewhat bold outside the gate. They had some stumbling blocks, but they persevere. They are just hustle.”

From Sri Lanka to Haiti to Louisiana

The date of crowding dates back to more than 15 years to Sabel and his authors, Bob Bernder, given the construction of natural gas facilities around the world from Sri Lanka to Haiti before being exported from the United States

Sabil, a banker for investment and a businessman, says he was having lunch in a restaurant in Washington, DC, when Nadili Sri Lankan paid the idea of developing a coal factory after the end of the civil war in his country of origin.

Sabil was fascinated, and through a lawyer friend, Bob Bernder met, then a partner in Hugan Luvils, who brought experience in financing the project to the table.

“(My wife) was happy to allow me to go to Sri Lanka in the middle of the Civil War,” said Sabul laughing. SABEL made a trip and quickly realized the greatest need in Sri Lanka and a scientist all over the world for the regasification facilities that get liquefied natural gas and run to gas to generate energy.

After the 2010 Haiti earthquake, Bandar worked as a legal advisor to the Haiti temporary recovery committee. SABEL and Piere saw a chance of Hitie to reduce her dependence on heavy heavy fuel oil to obtain energy by building smaller gas facilities.

“While we were looking at the small loads that could go to Haiti, we have made us think about smaller liquefies, which led us to look at the smaller development projects in the United States,” Sabel said.

Thus Venture Global was born with the idea of becoming great by going smaller. Binder is still the CEO with Sabel today.

When Venture Global submitted federal permits for the Calcasieu Pass project in 2015, the industry was largely rejected from the unknown outside whose project assumed, a little opportunity to become a reality.

“We are competing in the commodity market. Everyone produces the same product, so it really comes to costs and speed of production,” said Sabel. “Think about building a commercial office tower, but you know how you can start renting floors from bottom to top as you go. By the time you reach the top floor, you got a large amount of revenues that analyze the cost of construction.”

Development and contract took time-in providing cheaper and long-term deals for foreign buyers-but the first liquefied natural gas came online from Calcasieu Pass in early 2022, just as Russia invaded Ukraine, which sent global gas prices to rise.

Venture Global benefited not only from timing, but also because it takes years to develop these huge projects. When the competitors recently saw that Venture Global was legitimate, Sabil said, the company had three projects on Calcasieu Pass, Plaquueines – which is mostly online today – and CP2. The first stage of CP2 of $ 15 billion began near Calcasieu Pass and is scheduled to start producing LNG in 2027.

“By the time they realize (the competitors) – in one minute – we were not in failure, we got all this other market share,” Sabel said. “Well, we are now not the young emerging that we were a few years ago.”

Conflicts and victories

While Calcasieu Pass in Venture Global, small goods began to ship in early 2022 when prices rose, the final assignment did not complete and begin to fulfill the contract obligations until April this year.

There is rubbing. For three years, Venture Global has sold LNG to obtain heavier profits while the final trains have been completed before selling to contracting customers at cheaper prices. Customer claimed that this was a treatment-the company could have been selling at the cheapest and cheapest level from the beginning.

However, Venture Global suffered from the issues of the epidemic related to the epidemic, the delay of the hurricane, and the problems of energy supplies during the same time frame. He said that Venture Global could not fulfill all its decades until the LNG manufacturer ended.

But Shell, BP, Spanish main energy RepsolOthers came to arbitrate the conflict. While others are still commenting, Venture Global believes that he has a profitable precedent by winning the crust.

Even if Venture Global disturbs some in this industry, its low -cost approach allows it to provide cheaper contracts that continue to bring new customers from China to Europe.

Then, early this year, Venture Global publicly released its huge evaluation that wins eyebrows.

Rystad Energy Lang Mathieu Utting believes it was a calculated step.

Utting said: “We thought it was a bit strategic just to put it there on a very large number, then let it go down, because it looked like the number that ended up, they were still very happy.” “But it was definitely a bit strange.”

Regardless, SABEL is not satisfied with the share price, despite its height.

“We are not very satisfied with the performance of the arrow, and we expect-as people see us, we implement and go beyond what we have said that we will do-that it will stay right.”

He added: “Perhaps all the CEO of history said.”

The discussion on the future of Venture Global is now turning into Bulls versus Bears. When the Biden Endowment Department of LNG has been allowed to allow preventive materials, it is largely related to environmental concerns along the Gulf coast. But the argument also focused on the construction wave that leads to global gas vaccination prices and difficulties.

Utting believes that an abundance is on its way starting in 2030 and continues until 2035 or so – when VG is largely ended in the amazing increase of growth wave. LNG imports in China are of maximum anxiety.

Venture Global and WeIXEL, from East Dali, is much more difficult, on the pretext that global demand will remain faster than many expect with electricity and Amnesty International and Switch coal to gas.

Venture Global is already near the ability to export 40 MTPA (one million tons annually) of liquefied natural gas between Calcasieu Pass and Plaquueines. The CP2 project will add another 28 MTPA.

The subsequent and smaller expansion in CP2 would bring another 10 MTPA and expand the planned Plaquemines before 2030 will lead to about 25 MTPA. This would exceed 102 million metric tons of the annual capacity by 2030 if things go as planned.

Finally, the CP3 project is under development for another 30 MTPA after 2030.

For comparison, Cheniere, the current leader of the industry, aims to grow to about 75 MTPA near 2030 – beige growth, but does not keep pace with Venture Global plans.

“This is like Barry Bonds and Mark McGueri in that,” Wixel said, and compared them to retired retirees.

SABEL is preferred to compare VG with another sport.

“We have Esprit de Corps From a football team in a small town. He said: “Nobody wants to let his teammates let him down. To this day, we are still feeling that we are the weak that many people roast, and make us gather to play.”

https://fortune.com/img-assets/wp-content/uploads/2025/09/GettyImages-2195694824-e1758726312574.jpg?resize=1200,600

Source link