Good morning. Verizon does not see Amnesty International just a tool to enhance efficiency but as a possible new revenue engine.

I recently spoken to Verizon Cfo Tony Skiadas, who discussed how the company works to re -display parts of its wired network to support the burdens of artificial intelligence work and what this might mean for the future Verizon.

Wire re -imagine for artificial intelligence

Skiadas explained that Verizon (No. 30 In Fortune 500), it tests ways to benefit from its current central offices – where the capabilities are largely released as copper networks are replaced by fiber – for the strength of artificial intelligence processing on the edge.

“The fibers take a small part of the area compared to the old copper network,” Skiadas told me. He said that this liberates the facilities equipped with an area, strength and cooling – what is required to deal with the burdens of artificial intelligence on a large scale.

The initiative, called Verizon Ai Connect, focuses on reusing these assets instead of selling them. According to Skiadas, the mix of facilities and fiber positions in Verizon to serve the superfugores – technology companies that require a customized infrastructure – with a unique value. He said that the company may have to spend some capital on its facilities, but it already has many assets in force to provide these widespread work burdens.

“This may be an average to a long -term exercise,” he pointed out, because every deal is very special. ” We talked about a billion -dollar sales path at the beginning of the year, and this is already multiplied in terms of possible opportunity. ”

Skiadas explained that some smaller agreements may be achieved this year, the largest deals will take more time due to the complexity of building fiber or accompanying upgrade. He said: “It is not an upside down.” He added that the current level of demand is encouraging and will help direct the place where the company is investing.

You have Verizon

behind Skadas said custom customers, Verizon also uses Amnesty International internally to improve efficiency and service. He pointed to the allocation that artificial intelligence moves in its customer’s plans, the tools that help support agents in finding answers faster, and improving the network supported by machine learning.

He said artificial intelligence makes Verizon customer service more efficient and more effective. “The customer does not wait 10 or 15 minutes to get an answer.” He added that Verizon also applies artificial intelligence in its network and through the functions of the back office to improve prediction, accuracy and decision -making.

“I am paying my own team in this also to continue innovation,” Skadas said. “Even I am using them myself for simple things.” For example, it uses it to digest reports and summarize the documents. He said, “It is time for me.” “And I say to people, if I can use it, anyone can. So this is an incentive for my team.”

Regarding an artificial investment return procedure: “I think it will take some time,” Skiadas said. It is easy to determine some benefits, such as productivity gains in customer care, while others – such as financing efficiency or better decision -making – are difficult to measure directly. He emphasized that the real action is the effectiveness of Verizon employees to make upscale decisions. Ultimately, Skiadas sees the value of artificial intelligence less looking back and more in improving prediction accuracy, guidelines, and enabling employees to focus on higher value work.

Skiadas asked what he believed to make Verizon stand out among her competitors. Over the past seven years, Verizon has invested about $ 200 billion of wireless spectrum and networks – taking into account nearly $ 17-18 billion dollars annually – to constantly boost its network.

He said: “This is really the distinctive feature of our company, then giving customers option and flexibility.”

Sherrill Istra

[email protected]

Leaders

A big deal

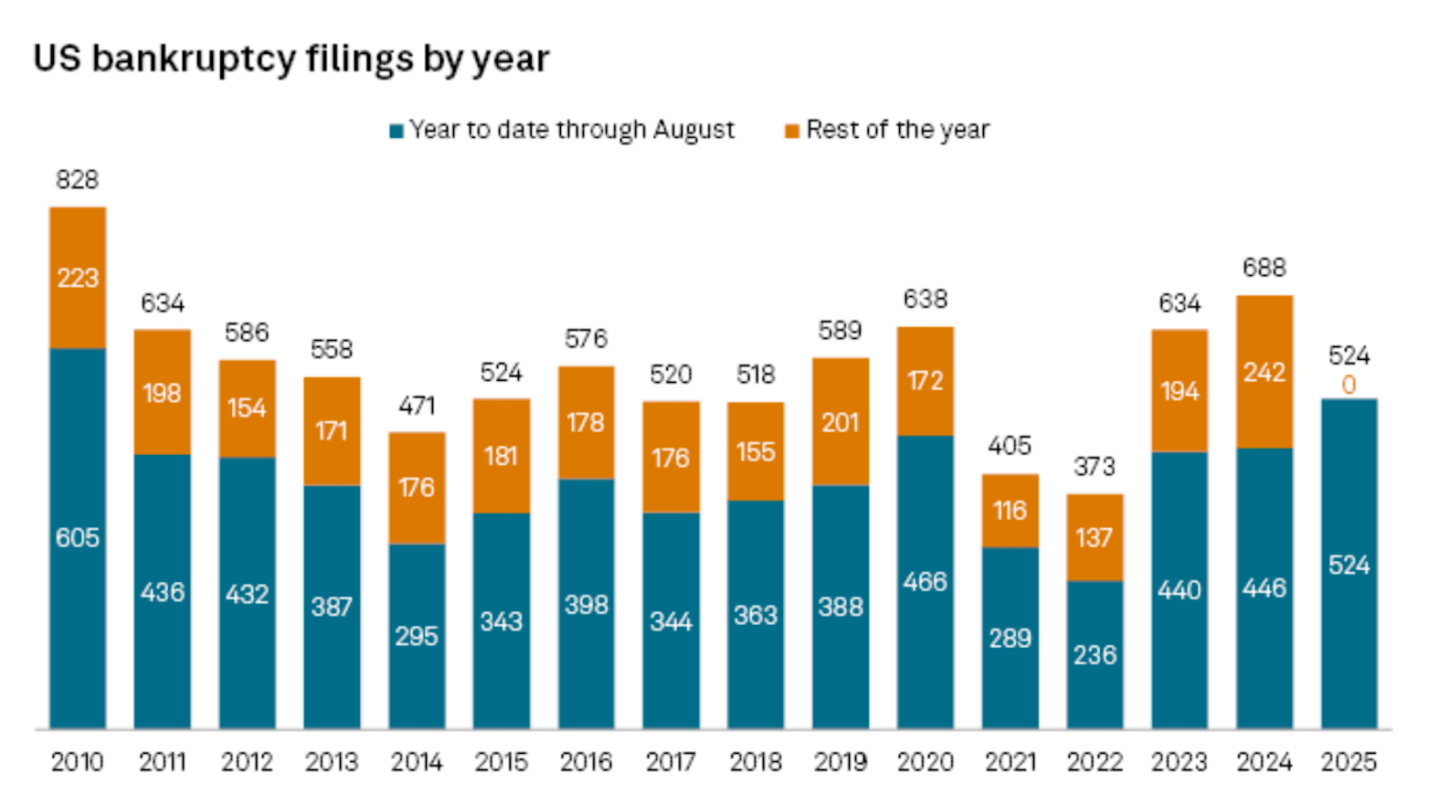

American companies reduced debts in the second quarter, According to the S&P Global Market IntelligenceAnd we can see more relief in the coming months as the Federal Reserve is expected to resume interest rates. “However, the effect of these cuts may be limited if the revenue of the medium and long time is not decreased as well as the FBI policy,” the report says.

deepen

“Trump wants to end a half -century age mandate for how to report companies about profits.” luck a report Written by Nino Pauli.

From the report: “In fact, social truth mail On Monday, President Trump said that companies should be asked instead only to spread profits every six months, pending the approval of the US Securities and Stock Exchange Committee. Trump wrote that this change would break the mandate of the quarterly reports that have been present since 1970. “This money will save and allow managers to focus on managing their companies properly.” He added that China has a “50 to 100 years’ offer to manage the company”, unlike American companies required to report four times in the fiscal year. The Hong Kong Exchange in China allows companies to provide voluntary quarterly financial disclosures, but it only requires them to report its financial results twice a year. ”

Hearing

“The well -designed digital identity system is not only verified that you say you are. It also protects your ability to limit what you reveal.”

-will Wilkinson, dIRECTOR for government affairs for the identity provider’s personality, written in a luck Category Entitled “America needs a digital identity strategy.”

https://fortune.com/img-assets/wp-content/uploads/2025/09/GettyImages-1766144273.jpg?resize=1200,600

Source link