The housing market has long been seen as an early warning mark, and one datab point in particular has caught the attention of the chief economist in Moody analyzes Mark Zandy.

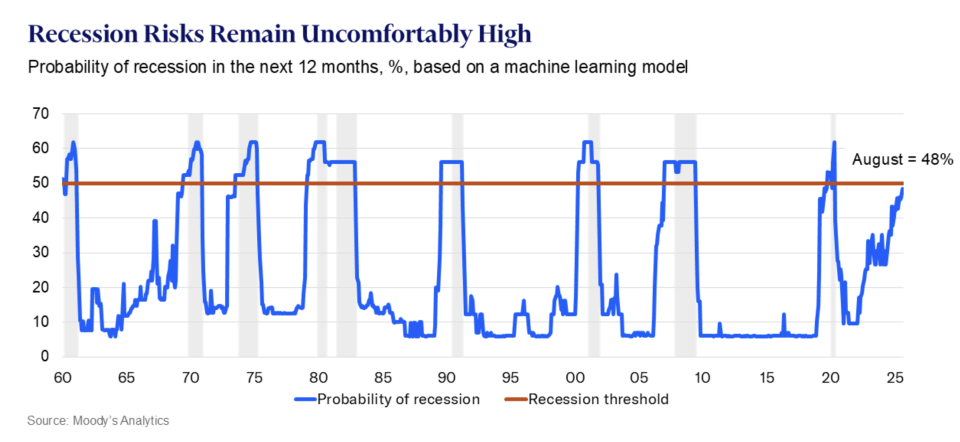

in Social media publications On Sunday, he indicated this The leading economic index of MOODY I have been able to learn that recession in the next 12 months is now 48 %.

Although less than 50 %, Zandy indicated that the possibility was absolutely not previously high without the economy eventually slipping into a shrinkage.

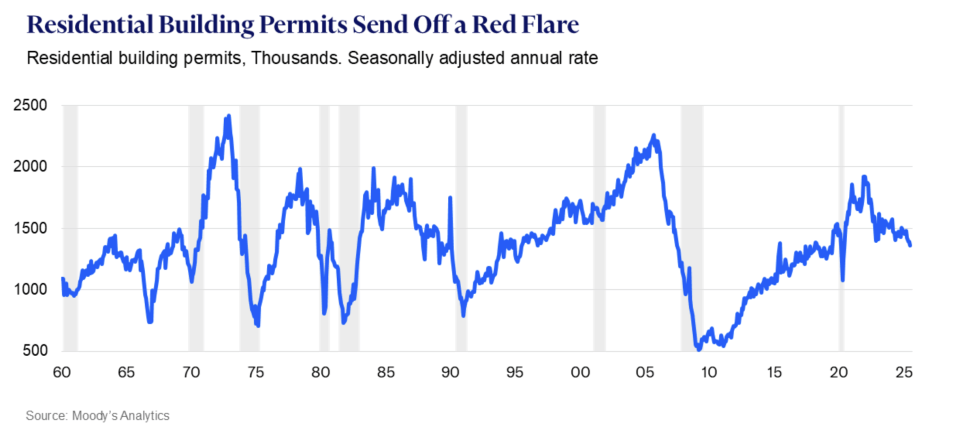

A decisive component comes in the MOODY index from the housing market.

“The algorithm has identified construction permits as the most important economic variable for stagnation. Although the permits were reasonably well, the builders supported sales by buying interest rates and other incentives, the inventories of unproductive houses are now high and at a height.”

“In response, the builders retreat, and the permits began to decline. It is now low as it was since the epidemic was closed.”

Last month, the Statistics Office mentioned this Residential construction permits in July An annual rate of season is 1.35 million, a decrease of 2.8 % from the previous month and a decrease of 5.7 % from last year.

In July, Zandy allocated the housing market to worry, His escalation to “Red Strait” With home sales, home prices and home prices were pressed by high mortgage rates.

while The fixed rate has decreased for 30 years since then From approximately 7 % to about 6.3 %, it is not yet clear whether this is low enough to revive the builders or the amount of what will continue to decrease. On Sunday, Zandy said that all eyes should be on the August statement data, which will appear on Wednesday.

“Certainly, they will provide another reason for the Federal Reserve to express prices later that day,” it predicted.

In reality, Politics makers have already started anxiety About the housing market. Minutes of the central bank meeting in July revealed concerns about poor housing demand, high supply, and decrease in home prices.

Housing not only appeared on the FBI radar, but officials have informed him as a potential danger to jobs, along with artificial intelligence technology.

“In addition to the risks caused by the customs tariff, the potential negative risks included the employees mentioned by the participants, a potential tightening of the financial conditions due to the high risk installments, the more fundamental deterioration in the housing market, and the risks that increasing the use of artificial intelligence in the workplace may reduce employment.”

The permits are not the only housing market data point that must be followed. Economy Ed Limmer, Who died in FebruaryThe famous paper published in 2007, which stated that residential investment is the best pioneering indication of the upcoming recession.

In this result, the data does not look good either. in The second quarterThe housing investment decreased by 4.7 %, accelerating the first quarter decrease by 1.3 %.

https://fortune.com/img-assets/wp-content/uploads/2025/09/GettyImages-2229115477-e1757871936432.jpg?resize=1200,600

Source link