The economic headlines were recently bleak. the Job report from July The narration said that the economy of 2025 was strong, as he reviewed the previous numbers down and revealed something close to a 80 % collapse in employment, even when inflation infiltrated the top and the demobilization operations continued. August was another bad, with only 22,000 jobs. But what if this is the lower part of the “circulating” secret recession in its place for nearly three years, and its date dates back to 2022? This is what the best mind in Wall Street believes.

Mike Wilson, the chief American stock strategy in Morgan Stanley, says that the August report is actually more confirmation of its preliminary thesis dating back several years. “The idea that the economy has been much weaker for many companies and consumers over the past three years, which indicates major economic statistics such as GDP or employment,” Wilson team wrote in a note published on the morning of September 8.

In other words, among many Predictions from recession It is about to hit the American economy or revive the lines of the seventies RecessionWilson was hitting the drum that was already the recession here, just in camouflage. The good news is that if the recession is hidden, then the current emerging market in the early stage, “On Friday, the weak work report provides an additional guide on our thesis that we are now moving from the recession circulating to the recovery.

“Related Display”: What happened?

According to Lilson and his team in Morgan Stanley, the recession was never achieved as a sudden collapse or a sharp rise in unemployment. Instead, the transfer of weakness in the sector from the sector winners such as technology and consumer goods to the rest of the economy, with every industry that suffers from its contraction at different times. This “circulating recession” means the usual signs of broad economic pain – individually unemployment, and decreased domestic GDP – it was mute even with the weakness that was installed under the surface. “We have seen most of the economy sectors pass through its individual ride periods at different times,” the bank said.

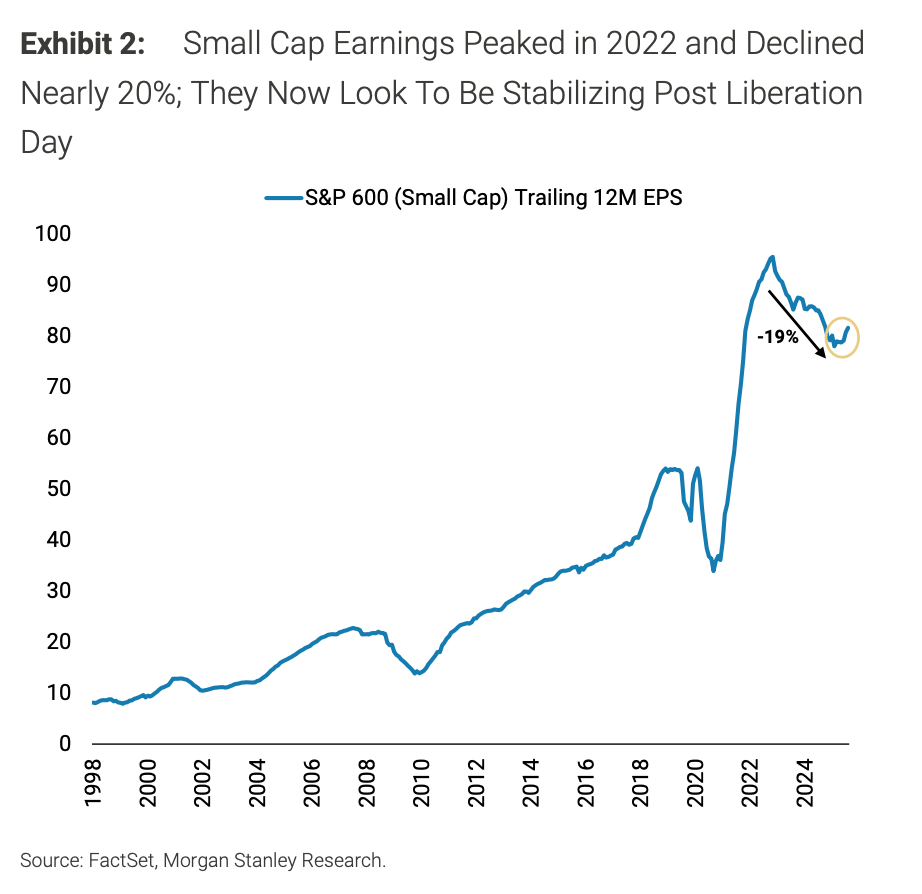

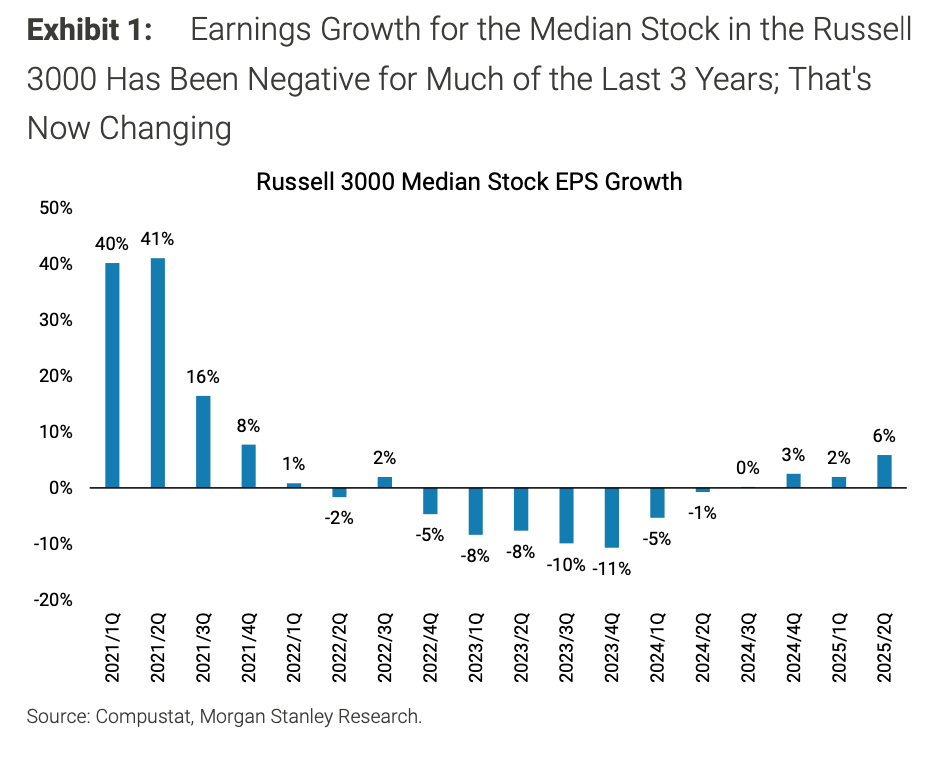

Several factors contributed to this slow -moving pain. The era of immigration after birth, followed by more strict enforcement, has distorted many traditional labor market signals and the actual time of address statistics. Average profit growth for companies via Russssell 3000 index Keep For three years – the total stock market appears to avoid collapse, until recently.

Was the liberation day the bottom?

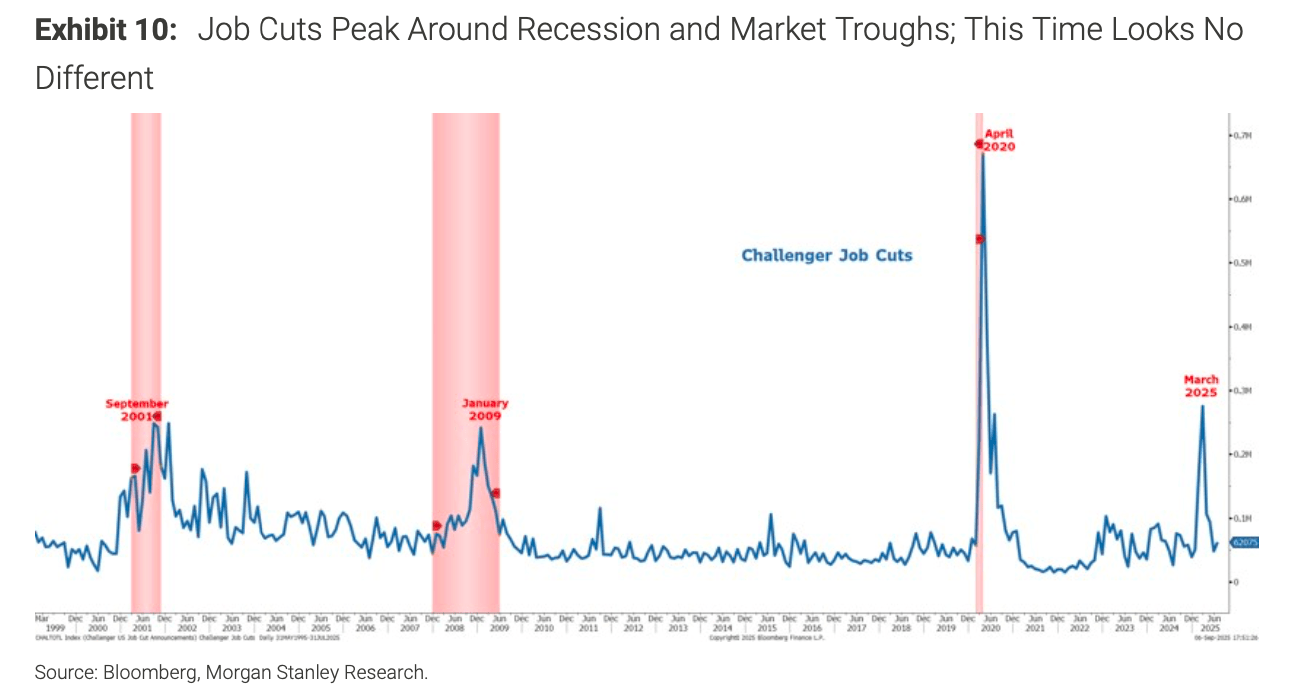

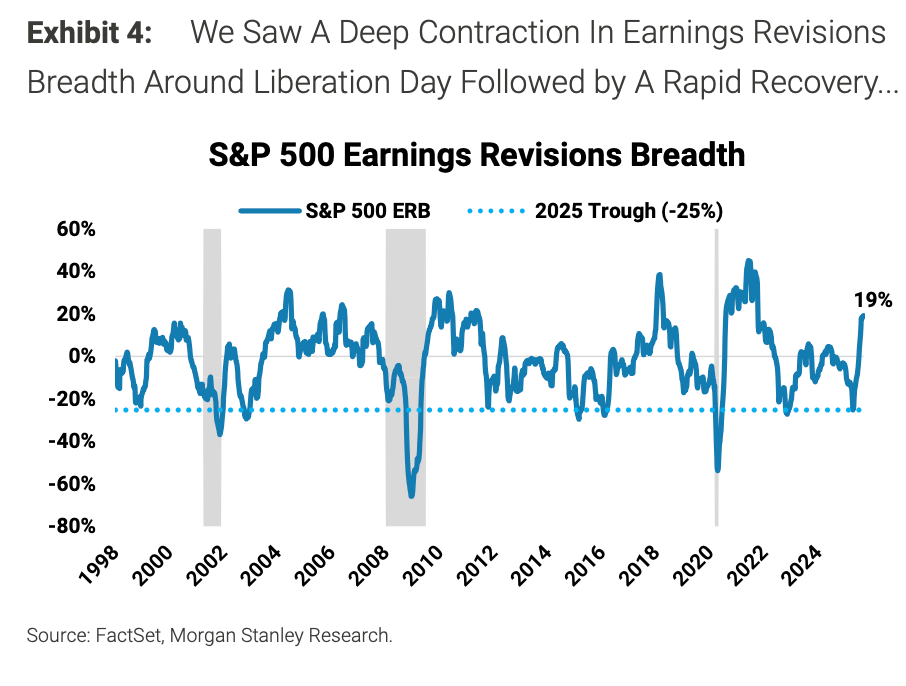

Morgan Stanley refers to April 2025, when the White House announced a new tariff in a move called “Liberation Day”, as the recession basin. On this reflection point, driving indicators such as profit reviews-Corporate Guidance-Dramatic and V-shaped counterators are highlighted since the early recovery of the epidemic. It also confirmed the reviews of salary lists and the data reduction data, and reached its climax last spring and decreased since then.

“History indicates that these reviews are in support of the course, as they have become more negative in stagnation and more positive as soon as the recovery begins,” the strategists note. “It seems that this time does not differ.” Wilson wrote, that the sharp recovery in the last month of salary reviews supports the opinion that the recession has ended.

The Morgan Stanley team argues that the main economic data – GDP local output, and extensive employment numbers – reality, often misses serious weakness. Classic models have failed to discover the nature of stagnation because the sectors fell and regained at different times. The government’s employment is more pain in the private sector, the disruption of the supply chain, consumer confidence drops, and the growth of continuous negative intermediate profits have drawn a true image.

Wilson argues that looking at profit growth as well as consumer confidence polls and companies is a “better way to measure the health of the economy.” Through these scales, profit growth was negative for most companies over nearly three years, as Wilson argues, and a V -shaped bounce appears in profit reviews to the top that companies’ confidence “has improved financially since liberation day.”

Taurus market forward?

Morgan Stanley reduces the reduction of federal reserve rates – the current current of 5 basis points from the point that resulted in weak labor last summer – will work on a solid recovery. Strategists argue in the new session, “a strong end was established at the end of the year and 2026”, provided that monetary policy remains enough to support growth.

The stock strategy recommends “linking” to volatility in the coming months with the continued seasonal cutting and cash uncertainty, but they ultimately expect profits to restore profits on a large scale and its highest new levels ever, especially with the start of the cutting cycle in the FBI. Sectors such as large Cap Healthcare provides, in particular, defensive value and profit momentum in this transition, while small covers may be later caused with the expansion of the recovery range.

Morgan Stanley’s invitation is a shift in how Wall Street explains the “stagnation”. Instead of one event, the decline may come in waves, and its climax at different times across the economy. For investors, the end of these trading recession signals not only hide, but a renewable opportunity: the next bull market is now with improvement with the basics and bearing supportive monetary conditions.

For this story, luck The artificial intelligence is used to help with a preliminary draft. Check an editor of the accuracy of the information before publishing.

https://fortune.com/img-assets/wp-content/uploads/2025/09/GettyImages-2177017208-e1757348246498.jpg?resize=1200,600

Source link