As John Carney from Berberart said, the Federal Reserve went to the war against the customs tariff. Unlike the Middle East, this is a false war.

The Federal Reserve, by stubbornly, rejects its target rate, because they decided that Mr. Trump’s tariff would increase inflation. So I ask, exactly what is your introductory inflation model? Because so far, with a 10 % foundation tariff in recent months, inflation rates have decreased, not. Since January, the consumer price index has decreased to only 1.4 % annually, less than the goal of the Federal Reserve by 2 %. Therefore, the induction inflation was missing at work. However, Jay Powell does not refer to this.

Powell himself is not economical. It is basically a bureaucratic led by several hundred economists in the employees of the Board of Directors. But again, we don’t know what their model is. The entire federal reserve bank is now guilty of collective thinking. President Trump has finally fined this problem by saying that the Federal Reserve is complicit with Jay Powell’s mistakes. The group is thinking is a bureaucratic disease. All these federal backup ads have 12 votes. Where do they appoint Trump? Where is Mickey Bowman, the new vice president of supervision? Where is Chris Wald, a former professor of economics at Notre Dame? Where is some diversity of thinking, and why the members of the Board of Directors do not wonder about slippery and informed tales in his new introductory war of inflation?

Former Newt Gingrich’s Speaker New Parliament discusses how President Donald Trump should respond to the Israeli conflict and what is at the stake at Kudlo.

Federal Reserve policy is completely transparent and transparent. We have no idea how they reach their conclusions.

Therefore, here is an idea: During the first period of Mr. Trump, a number of definitions were placed. During the Chinese commercial conversations, he carried out a 25 % tariff on China.

In addition, put a 25 % tariff on steel and aluminum, 30 % of the tariffs on solar panels, and 20 % tariffs on washing machines – however the inflation rate during those years was essentially 2 % or even less. You cannot create an economic model that simply depends on one variable.

For example, the tax cuts in Trump increased in the first chapter of incentives to invest and produce business, creating more commodities on the side of the offer, and more productivity as well, all of which helped maintain inflation during the growth of the economy. In fact, production is increasing for five years for non-financial companies at a rate of 2.6 %-growth without enlargement.

Republican Congress is about to pass the tax reduction bill This will include permanent immediate cash expenditures for machines, equipment and factories. This type of capital deepening for a long time will stimulate more growth without any enlargement, according to a recent academic study published by Nber. Now, I ask, did the federal reserve included this in its economic models? We do not know. They do not say. They are only clinging to this idea that Trump’s tariff, which already aims to reduce commercial barriers and settle the field of commercial play, and open the market access to American companies-and all of which can actually reduce inflationary pressures by stimulating more growth in the offer-and of course, the policy of liberating Mr. Trump aspiration, another step to combat Talawi.

Senator Ted Cruz, R-Texas, the most influential parts of the “Kudlow” tax bill.

But Jay Powell never talks about any of these tax and organizational reforms. Instead, at his press conference this week, he was exploding to say, “The increases in definitions this year are likely to rise and discourage economic activity,” then says, “Everyone I know expects a meaningful increase in prices from customs tariffs because someone must pay.” Huh? I know a group of people who think the sources will pay. I know other people who believe that our companies will pay. In fact, I know a full range of people who do not think that customs tariffs can be inflated because width of money has decreased from 30 % to only 4 %. Or even if the consumer has to pay more for one element, they will pay less for another element, and leave the price index flat.

Therefore, I return to Jay Powell and the entire spare group thought. Someone should tell him that he is responsible for monetary policy, not commercial policy. He has no idea about future commercial deals or tariff prices. Someone must tell him to explain to the American public what he does at the mortgage rates, their credit cards, and their car loans.

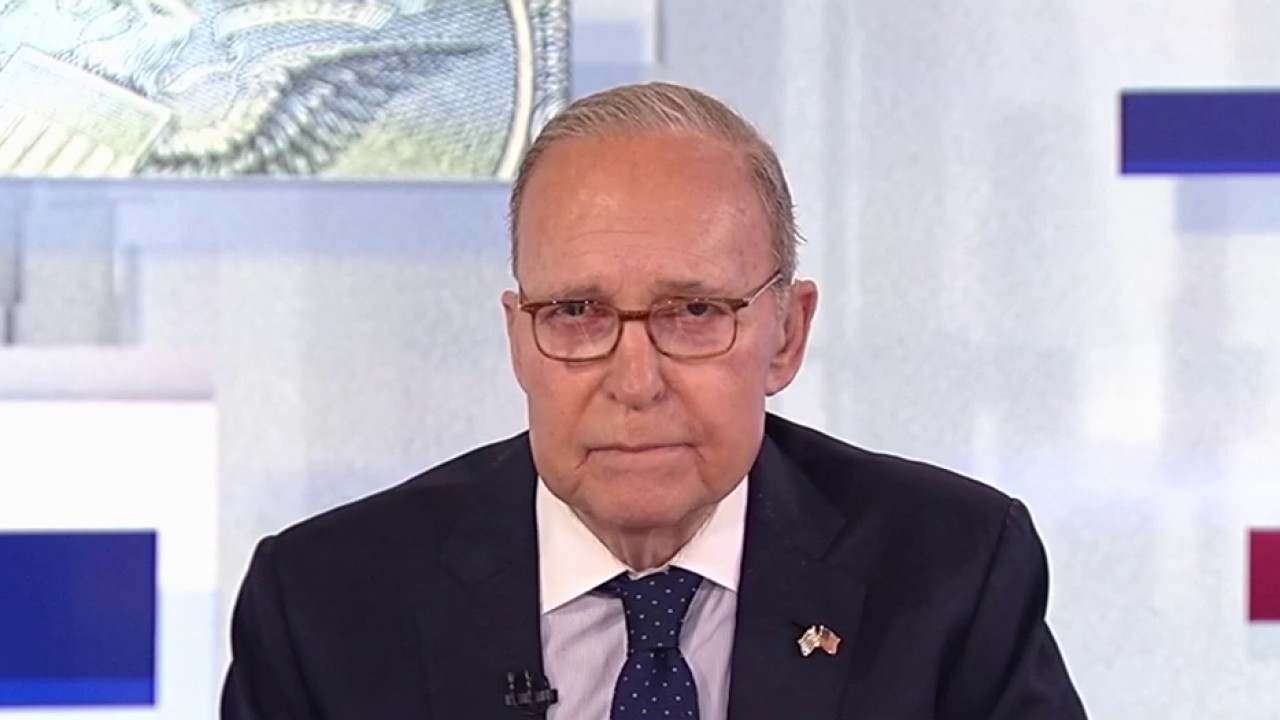

https://a57.foxnews.com/static.foxbusiness.com/foxbusiness.com/content/uploads/2025/02/0/0/larry-kudlow-1.jpg?ve=1&tl=1

Source link